Start Building Your Child’s Credit

Cashless payments have seen exponential growth in the last decade and are steadily becoming the new norm. There’s a high chance your child is at least aware of debit cards, even if they’re young, and they may have shown interest in obtaining one.

In this case, replacing cash with a kids’ allowance card can be a good decision. This article explains how your child can benefit from such cards and gives examples of cards that let children take on more responsibility for their personal finances.

What Is an Allowance Card for Kids?

When talking about children’s allowance cards, people typically refer to prepaid cards. While they may seem similar to traditional debit cards, prepaid options have two significant differences:

- They’re not connected to a bank account

- They often have lower age requirements

Instead of a checking account, your child only receives a card that you load with funds. The vast majority of options are reloadable, but you may find single-use cards if you need one for a specific purpose, such as your child’s school trip.

The parent has full control of the card, which is why such options are more available to young children than standard debit cards. Some providers don’t have any age requirements, while those that do typically have low thresholds (5–6 years).

The main benefit of a prepaid card is that it gives your child more—but not too much—freedom to manage their finances. They can develop healthy spending habits while you retain control over the card to help them stay on the right path. You can do this through numerous parental control measures, such as:

- Spending limits

- Chore-based allowances

- Restrictions of specific vendors and purchase types

The exact controls and other features depend on the provider. There are plenty of options to explore, so thorough research can uncover the ideal solution for your child’s needs.

What To Look for in Prepaid Cash Cards for Kids

Prepaid card providers add lots of bells and whistles to their solutions to outcompete one another. This can lead to analysis paralysis and make it hard to focus on the right selection criteria.

While browsing different options, you should assess five main factors:

- Loading and payment options—Besides direct deposits, your child’s card should support different transfer types like peer-to-peer sharing and cash deposits. Pay attention to the fees related to such transactions, as some providers charge hefty ones

- Financial education tools—Prepaid cards typically come with mobile apps that let your child manage their money. Look for options with robust education tools like financial literacy resources, savings options, and goal-setting features

- Monthly fees—Most prepaid cards come with monthly fees, which can add up with time. Look for options that either have low fees or high value for money

- ATM network—Your child will likely make frequent withdrawals, so your card provider should have a wide network of fee-free ATMs

- Parental controls—A prepaid card should teach your child to manage their money under close supervision, so make sure your solutions can prevent reckless spending and other common issues

Best Money Cards for Kids—Three Options To Consider

If you’re not sure where to start your search for prepaid cards, the following options are worth checking out:

- Bluebird by American Express

- GoHenry

- FamZoo

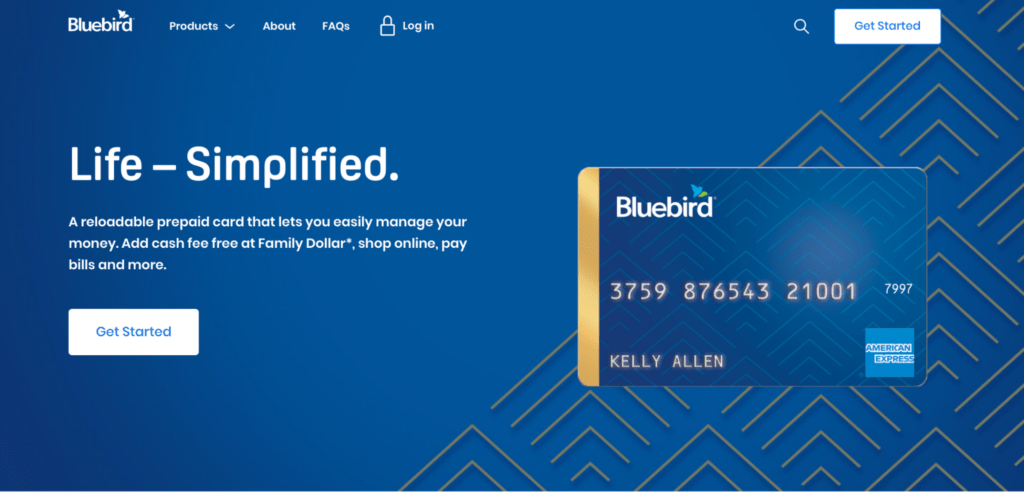

BluebirdⓇ by American Express

Source: Bluebird

If you’re looking for a budget prepaid card stripped down to some basic financial management features, Bluebird can be a good choice. It has no monthly fees, and getting started is free if you create an account online. The card also supports free withdrawals on over 37,000 ATMs, so your child can save up quite a bit.

Bluebird supports online bill paying, so it can be a useful tool for teaching your child how to make the necessary payments as they grow up. It also lets you track your child’s spending and set limits through the app.

The main drawback of this card is a lack of educational resources and tools. It’s not the best option for improving your child’s financial literacy beyond showing them the ins and outs of cashless payments. Bluebird is also unavailable in Vermont, so VT residents need to look for alternatives.

The following table summarizes the pros and cons of Bluebird:

| Pros | Cons |

| No monthly fees Free online registration Large ATM network | No educational tools Unavailable in Vermont |

GoHenryⒸ

Source: GoHenry

GoHenry is a prepaid card combined with a full-fledged money management and education app. It’s a pricier option compared to some competitors, but it may be worth the money thanks to its many features, most notably:

- Chore and allowance management

- Merchant block, spending limits, and various other parental controls

- Money Missions that teach kids about numerous aspects of personal finance, such as budgeting and credit

The minimum age is six, so your child can start learning about money early in life. Obtaining a card for one child costs $4.99/month, and you have to subscribe to a family plan at $9.98/month to add up to four children.

You can compare GoHenry’s benefits and drawbacks in the following table:

| Pros | Cons |

| Various educational resources Chore management Low minimum age | Slightly pricey Can only add up to four children |

FamZooⒸ

Source: FamZoo

FamZoo is a versatile prepaid card that focuses on learning through practice. While it may not have an extensive educational library like GoHenry, it’s packed with features that let parents teach children the value of money and wise financial decisions. Such features include the following:

- Splitting accounts into categories for different purposes (saving, spending, investing, etc.)

- Automated allowance and chore charts

- Informal loans with parent-defined interest rates

- Parent-paid interest for encouraging your child to save

These features somewhat make up for the lack of strict parental controls. While you can keep close track of your child’s spending, you can’t block specific merchants or purchase types—your child can use the card wherever Mastercard is accepted.

Age requirements are also not ideal, as your child needs to be at least 13 to register for the account.

The following breakdown shows FamZoo’s main pros and cons:

| Pros | Cons |

| Dedicated account categories for different purposes Lots of automated features Parent-controlled loans | No advanced parental controls Only available to children who are 13 and over |

How To Use Money Cards for Kids To Prepare Your Child for Adulthood

Prepaid cards are an excellent way to make your child a more responsible spender and instill the necessary financial habits they’ll need throughout life. They also help you get the child ready for other financial products, such as credit cards.

You can simulate the relationship your child will have with lenders to help them learn the importance of meeting their obligations timely. Doing so will lower the chances of your child making costly mistakes that can damage their credit score.

Your child has plenty of time to learn, as they won’t have access to independent credit products before becoming legal adults. Even then, they might have to wait a few more years because the CARD Act of 2009 made it difficult to obtain credit cards before turning 21.

Besides overcoming these limitations, your child should have a strong credit profile to obtain loans without complications. This is something a prepaid card can’t help with, as activity related to it isn’t reported to credit bureaus. Luckily, there’s another product that can build your child’s credit and set them up for a more stable future—FreeKick.

Go Beyond Financial Education With FreeKick

While it’s important to provide your child with a financial education, you also need to take solid steps to give them a bright financial future, such as building their credit profile and protecting their identity. FreeKick by Austin Capital Bank is an FDIC-insured deposit account that offers both of these services.

FreeKick’s Credit Building Service

All children aged 13 to 25 can benefit from FreeKick’s credit building service. To reap its advantages for your child, take the following steps:

- Create an Account—Sign up on FreeKick.bank and choose a deposit that suits your budget

- Set It and Forget It—FreeKick will start building 12 months’ worth of credit history for your children

- Keep Growing—After 12 months, either close the account without any fees or continue building credit for your child for another year

With these simple steps, your child can have up to five years of credit history once they turn 18. This will help them save $200,000 during their lifetimes as they’ll be able to secure loans on favorable terms.

FreeKick’s Identity Protection Service

Credit building is incomplete without identity protection. Child identity theft occurs every 30 seconds, and if your children fall victim to it, their credit profiles can suffer significant damage. This is why it’s a good idea to invest in FreeKick’s identity protection service, which offers the following features for minors:

- Credit profile monitoring

- Social Security number (SSN) monitoring

- Dark web monitoring for children’s personal information

- Up to $1 million identity theft insurance

- Full-service white-glove concierge credit restoration

- Sex offender monitoring—based on sponsor parent’s address

FreeKick also offers identity protection for adult children and parents via the following features:

- Credit profile monitoring

- SSN monitoring

- Dark web monitoring for personal information

- Up to $1 million identity theft insurance

- Full-service white-glove concierge credit restoration

- Lost wallet protection

- Court records monitoring

- Change of address monitoring

- Non-credit (Payday) loan monitoring

- Free FICO® Score monthly

- FICO® Score factors

- Experian credit report monthly

FreeKick Pricing

FreeKick has two pricing plans:

| FDIC-Insured Deposit | Annual Fee |

| $3,000 | $0 (Free) |

| No deposit | $149 |

With both plans, you get:

- Credit building for six children aged 13 to 25

- Identity protection for two parents and six children aged 0 to 25

Secure your child’s financial future through good credit and a protected identity—sign up for FreeKick today.

Featured image source: Karolina Grabowska

Freekick provides a double dose of financial empowerment and security for your whole family. It helps teens and young adults build strong credit profiles and offers identity motoring for up to two adult parents and six children under 25.