Start Building Your Child’s Credit

Every parent wants a carefree and financially stable future for their child. As they become older, your child’s financial situation will be an increasingly important component of their life, so you should give them every advantage you can.

With that in mind, you might be wondering the following: “When should I open a bank account for my child?” The answer involves several considerations, which we’ll outline in this guide. You’ll learn about the best time to open different account types and ways to ensure a more financially stable future for your young ones.

How Early Can I Open a Bank Account for My Kids?

There are two main account types parents can open for their children:

- Savings account

- Checking account

When To Open a Savings Account for Your Child

Savings accounts typically don’t have a minimum age requirement—you can even open them for newborns. Doing so can be a good idea to maximize the account’s yield over time.

The main savings account types parents open for their children are joint and custodial accounts. The following table breaks down the key differences between the two:

| Consideration | Joint Account | Custodial Account |

| Process | The parent opens an account co-owned and co-managed by their child | The parent sets up and manages the account until the child becomes a legal adult. The account can also hold assets like stocks and bonds |

| Main purpose | Savings and accumulation through interest | Savings and investment in various assets |

| Account access | Both the parent and child can access the funds | Only the parent has access until the child reaches legal age |

| Child’s involvement | Active—the child can make deposits and withdrawals from the account | Passive until the child reaches the age of majority |

You can choose the account type based on your financial situation and goals. A traditional joint savings account is a simpler option, more suitable if you want to give your child some hands-on experience with money early on. If you’re in a position to invest and want your child to do the same and grow their wealth later in life, a custodial account is a better solution.

When Should Your Child Get a Checking Account?

If it’s time for your child to be more financially independent, opening a checking account in their name can be a good idea. It will most likely be a joint account, as minors can’t apply for an individually-owned one.

Age requirements can vary between banks, but most support checking accounts for children 13 and over. Your child might also get a debit card connected to the account, so this is a great way to introduce them to the banking system.

The exact age to open a checking account for your child mostly depends on personal circumstances. According to GoHenry’s co-founder Dean Brauer, 17 is the average age, but there’s no harm in doing it earlier if your child has shown interest in financial management.

Other indications it might be a good time to open an account for your child include the following:

- They’re mature enough and frugal with the allowance you’ve been giving them

- They got their first job and could use an account to store their salary instead of carrying cash or depositing the money into one of your accounts

- They want to start saving for college or other important milestones

Your child’s first checking account is an important matter you should approach with care. With the right preparation, it can help them build healthy spending habits they’ll carry into adulthood.

How To Open Your Child’s First Checking Account—Useful Tips

Proper financial education is one of the main responsibilities of every parent. A checking account gives you an opportunity to teach through practice over theory. To help your child start their banking journey the right way, make sure to:

- Let them participate as much as possible

- Encourage saving

- Highlight the importance of keeping sensitive information safe

Let Your Child Manage Their Account

From the moment you decide to open a checking account for your child, you should involve them in the process and decision-making. Browse different options together, and make sure to answer any questions they have about the account and banking technicalities.

When you open the account, show them how to:

- Read bank statements

- Use ATMs

- Transfer funds through the bank’s app or online portal

- Fill out forms for online purchases

After explaining all the basics, encourage your child to be as independent as possible while using the account. Leave room for mistakes as they’ll likely happen in the beginning.

Incentivize Saving

Source: Annie Spratt

When your child first switches from cash to a bank account and debit card, they might get carried away out of excitement. To prevent irresponsible spending, teach your child the value of keeping money in their account.

Some financial institutions offer checking accounts with interest, so your child may get a small Annual Percentage Yield (APY) on their available balance. Examples of such institutions include:

| Institution | APY |

| Alliant Credit Union | 0.25% |

| Capital One | 0.10% |

| Axos Bank | 0.10% |

*Interest rates current as of May 10, 2023

While your child’s account may not earn large sums through interest, it could be their first hands-on example of how frugality can pay off. If you go with a no-interest account, you can come up with a different reward system to motivate them to save up.

Teach Your Child To Protect Their Private Information

Online purchases are common among teens and young adults, so you must educate your child on the necessary safety practices. Scams are all around the web, so your child should be cautious about where they enter bank account information. Otherwise, a fraudster can breach their account and drain it.

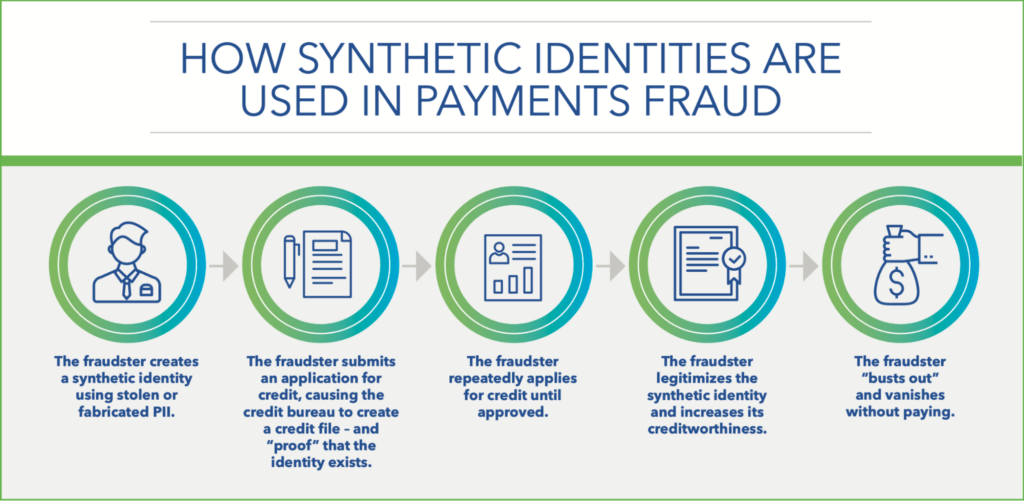

In the worst scenario, your child may fall victim to identity theft, especially if they’re a minor. Financial criminals specifically target minors because their information—like the Social Security number (SSN)—is clean and unmonitored, so it can be used for synthetic identity fraud. A malicious party can combine the SSN with made-up information to forge a new identity and defraud financial institutions.

The following diagram from the Federal Reserve’s whitepaper on synthetic identity fraud explains how this happens:

Source: The Federal Reserve: Detecting Synthetic Identity Fraud in the U.S. payment system

The perpetrator might obtain your child’s information through various scams, most notably:

- Financial aid scams

- Spoof quizzes

- Online gaming scams

Let your child know their personal information is extremely sensitive and shouldn’t be shared online or in person. When making online purchases, make sure they only buy from trusted sources.

Prepare Your Child for Adulthood by Introducing Other Financial Products

A checking account is only the first step in your child’s relationship with banks. As they get older, they’ll likely open credit accounts for various purposes, from buying a new phone to getting their first car.

While this may not be an immediate concern, it requires careful planning and preparation. You should start teaching your child about credit as soon as they’re mature enough, preferably in high school.

More importantly, you’ll need to play an active role in building their credit profile since it will determine their borrowing eligibility and capacity. It can take a long time to build a high credit score that will make your child’s future easier, so the sooner you start, the better.

Minors and young adults often can’t build credit independently because the CARD Act of 2009 made it hard for anyone under 21 to own credit cards. A common alternative is adding a child as an authorized user of your card, but this method isn’t particularly effective.

While your child does get a credit profile as an authorized user, it’s tied to your report, so issues on anyone’s end can damage both profiles. Aside from that, the child’s credit activity associated with your card will be deleted from their file when you remove them as an authorized user on your card, so they’ll be back to square one.

If you need a better way of supporting your child’s financial independence by helping them build a strong credit profile, check out FreeKick.

Build Your Child’s Credit and Protect Their Identity With FreeKick

There are two aspects of a good credit profile—a secure identity and a good credit score. Offered by Austin Capital Bank, FreeKick is an FDIC-insured deposit account that helps you cover both these aspects for your child.

Steps for Using FreeKick’s Credit Building Service

Your child is eligible for FreeKick’s credit building service if they’re between the ages of 13 and 25. This service is a good way to help them establish a credit history early on in life in only three simple steps:

- Create an Account—Create an account at FreeKick.bank and choose a deposit that suits your budget

- Set It and Forget It—FreeKick will start building 12 months’ worth of credit history for your child

- Keep Growing—After 12 months, close the account without any fees or continue building credit for your child for another year

With these steps, your child can have up to five years of credit history when they turn 18. This will help them save $200,000 during their lifetime by helping them secure better loan terms and other financial benefits.

How FreeKick Protects Your Child’s Identity

Child identity theft happens every 30 seconds, and if your child falls victim to it, all your credit building efforts can go to waste. In the worst case, your child might get charged with crimes like credit card theft, so it’s a good idea to proactively invest in protecting their identity. FreeKick’s ID protection services include:

| Services for Minors | Services for Adult Children and Parents |

| Credit profile monitoring Social Security number (SSN) monitoring Dark web monitoring for children’s personal information Up to $1 million identity theft insurance Full-service white-glove concierge credit restoration Sex offender monitoring—based on sponsor parent’s address | Credit profile monitoring SSN monitoring Dark web monitoring for personal information Up to $1 million identity theft insurance Full-service white-glove concierge credit restoration Lost wallet protection Court records monitoring Change of address monitoring Non-credit (Payday) loan monitoring Free FICO® Score monthly FICO® Score factors Experian credit report monthly |

FreeKick Pricing

FreeKick offers two pricing plans:

| FDIC-Insured Deposit | Annual Fee |

| $3,000 | $0 (Free) |

| No deposit | $149 |

With both plans, you get:

- Credit building for six children aged 13 to 25

- Identity protection for two parents and six children aged 0 to 25

Make sure you cover all bases when setting up your child for financial success—sign up for FreeKick today.

Featured image source: Kindel Media

Freekick provides a double dose of financial empowerment and security for your whole family. It helps teens and young adults build strong credit profiles and offers identity motoring for up to two adult parents and six children under 25.