The sooner you start investing, the more time your money has to grow. That’s why entering the investment world in your teens is an excellent way to set yourself up for a more carefree adulthood.

The problem is, you may struggle to find opportunities to invest in different assets. If you’re wondering how to invest as a teen, this guide will break down your options so that you can choose the most suitable one. You’ll learn the following:

- What criteria you have to meet to start investing

- What assets are available to teens

- How else you can improve your financial well-being

Can You Invest as a Teenager?

The short answer is—yes, you can start investing in numerous assets in your teens. Still, you may not be able to do it independently unless you’re a legal adult. Minors can’t open brokerage accounts, so you must be at least 18 (or older in some states) to get started.

If you’re under 18, you can start setting some money aside and invest it once you meet the age requirements. Alternatively, you can ask a parent or legal guardian to set up a custodial account in your name.

Custodial accounts are managed by legal adults on behalf of a minor beneficiary. All assets in the account belong to the beneficiary, who can access them when they become an adult.

There are various custodial account types, though three are particularly popular:

- Uniform Gifts to Minors Act (UGMA) accounts

- Uniform Transfers to Minors Act (UTMA) accounts

- Custodial Roth IRA accounts

The following table explains how each account type works:

| Account Type | Description |

| UGMA | A type of investment account focused on financial assets (mutual funds, stocks, bonds, etc.) |

| UTMA | A more versatile account type supporting financial assets alongside physical and intangible assets (art, real estate, intellectual property, etc.) |

| Custodial Roth IRA | A retirement savings account managed by the parent or legal guardian |

Talk to your parents to explore different options and select the account type that suits your investment goals. If you’re already a legal adult, you can skip this step and go straight to choosing your preferred assets.

What Can a Teenager Invest In?

Source: Aidan Hancock

There are numerous ways to build long-term wealth if you’re a legal adult, most notably:

- High-yield savings accounts (HYSA)—It’s a specific form of savings account offering a high interest rate. This is a good option for those who aren’t willing to take on significant risks or may not have extensive investment knowledge

- Stocks—A stock is a piece of a publicly traded company’s equity that gives you a small share of its ownership. You earn money by either getting paid dividends or selling your stocks when the company’s market value goes up

- Certificate of deposit (CD)—A CD is similar to an HYSA, except you need to hold money in your account for a predetermined amount of time to earn interest. This is another low-risk option letting you put your allowance or income to good use

- Bonds—Buying a bond means lending money to a financial institution. The bond serves as a security instrument and typically earns you a fixed interest

- Funds—A fund is a form of pooled investment managed by professional brokers. Funds invest in numerous assets and let you join in by purchasing a share of the fund. While not as low-risk as HYSAs or CDs, funds are safer than investing in assets independently as you get professional guidance and support

Your investment strategy will mainly depend on your goals and risk appetite. This is an important decision you shouldn’t take lightly, so don’t rush into any investment haphazardly.

Actionable Tips for Investing as a Teenager

If you’re ready to start investing—either independently or with a parent’s help—there are three important boxes you must check:

- Educate yourself

- Define your goals and investment style

- Understand the risks

Gather the Necessary Knowledge

Source: Joshua Mayo

Investing is a serious endeavor, and it can take years to develop the necessary skills. This is one of the main reasons why starting in your teens gives you a significant advantage.

It’s best to avoid high-risk assets until you’re confident in your knowledge and understanding of the market. Besides traditional sources of information like courses and books, you can find many apps aimed at aspiring teen investors.

You can even enroll in investment programs that don’t require real money to test your skills and increase your chances of making wise moves and decisions. Explore the available resources, and keep educating yourself to avoid making poor investment decisions.

Set Your Goals and Choose Your Investment Style

Retiring early and comfortably is the main motivator behind many people’s investment efforts. This still doesn’t mean it will be your goal—there are numerous reasons to start building wealth early on.

Your main goal will impact your investment style, which can be split into two broad groups:

- Income investing—Involves building a portfolio that generates an ongoing stream of passive income

- Value investing—The practice of investing in undervalued assets so that they can be traded when their value increases

Both approaches have benefits and drawbacks you should weigh before choosing the one suitable for you. Income investing typically carries less risk, but value investing might give you faster returns. Define your priorities and goals, and then choose your strategy accordingly.

Beware of Investment Risks

Source: Anne Nygård

There’s a common saying that you should never invest more than you’re willing to lose. This is an excellent rule to follow, as no amount of knowledge guarantees that your investments will pay off.

There are numerous risk types you should keep in mind, as explained in the table below:

| Risk Type | Explanation |

| Systemic risk | Unavoidable risks affecting virtually all assets (e.g., the 2008 financial crisis) |

| Liquidity risk | A chance that the demand for a particular asset will drop so much that you can’t sell it |

| Inflation risk | The probability of inflation negatively affecting an asset’s value |

| Interest rate risk | The risk of corporate or government bond investments losing value due to consistent interest rate increases |

No asset or investment strategy is risk-free, so beware of any opportunities that guarantee returns.

A Safe Way To Improve Your Financial Stability

Investing isn’t the only way to ensure a more comfortable and secure adulthood. Even if you accumulate a certain amount of wealth, chances are that you’ll need a loan or another credit product at some point. This is where a strong credit profile can be invaluable.

While it’s not considered an investment in a traditional sense, your credit profile can pay off quite handsomely—it can save you over $200,000 throughout adulthood!

Much like investing, credit building may not be available to many teens. Because of the CARD Act of 2009, anyone under 21 must meet one of the following two conditions to obtain a credit card:

- Showing a proven ability to repay the debt independently

- Having a co-signer over 21 who can assume responsibility for the debt

As many teens can’t meet these criteria, parents often decide to help by adding them as authorized users of their cards. This creates a credit profile for the child sooner than they’d get one independently.

The problem is, it also binds the child’s credit profile to the parent’s—the authorized user inherits their parent’s credit history, and any reckless behavior damages both profiles.

Worse yet, the child only builds credit while they’re registered as an authorized user. As soon as the parent removes them, all credit history associated with the card is deleted from the child’s profile.

To let parents invest in their children’s future without risks and drawbacks, Austin Capital Bank created FreeKick.

Parent-Sponsored Credit Building With FreeKick

FreeKick helps parents give their children a significant advantage in life by establishing and building their credit profiles. It does so by combining a Federal Deposit Insurance Corporation (FDIC)-insured deposit account with credit building and monitoring services.

If you’re a parent looking to make your child’s future easier, you can get started in three quick steps:

- Create an Account—Go to FreeKick.bank and choose a plan based on a one-time deposit:

- Free—FDIC-insured deposit of $2,500

- $49/year—FDIC-insured deposit of $$1,750

- $99/year—FDIC-insured deposit of $1,000

- Set It and Forget It—FreeKick automatically builds 12 months of credit history for your child

- Keep Growing—When the 12-month term ends, you can renew the account and build up to 48 months of credit history for your child or cancel it and get the deposit back

FreeKick reports the child’s credit history to credit bureaus if they’re a legal adult. If the child is a minor, credit history will be reported as soon as they become an adult and activate reporting through a simple process.

The account can be closed at any point without penalties, but a minor’s credit history can’t be reported if the account is canceled before they become a legal adult.

Enjoy FreeKick’s Credit Profile Monitoring Services (Coming Soon)

Much like an investment portfolio needs continuous tracking, a credit profile requires close monitoring that prevents errors and ensures all information is accurate. This is yet another responsibility a parent assumes until their child is old enough to do it themselves.

FreeKick includes credit profile monitoring services with each account at no additional cost. By doing so, it also significantly reduces the chances of identity fraud, which affects one in 50 U.S. children annually.

If you want peace of mind knowing that your child’s information is safe, you can take advantage of the following security measures:

- Social Security Number (SSN) Tracing—Tracks all crucial data related to your child’s SSN to detect signs of identity fraud

- CyberAgent Dark Web monitoring—Stays on the lookout for the potential trading of the child’s personal information on the internet

- Full-service ID restoration—Restores the child’s identity to its original form in case of theft. FreeKick covers ancillary restoration services with a $1 million insurance

- Sex offender monitoring—Provides a report if a registered sex offender in your area registers under a different name

- Services designed for adult children:

- Lost wallet protection

- Change of address monitoring

- Payday loan monitoring

- Court records monitoring

Improve your child’s financial stability and keep their information safe—sign up for FreeKick.

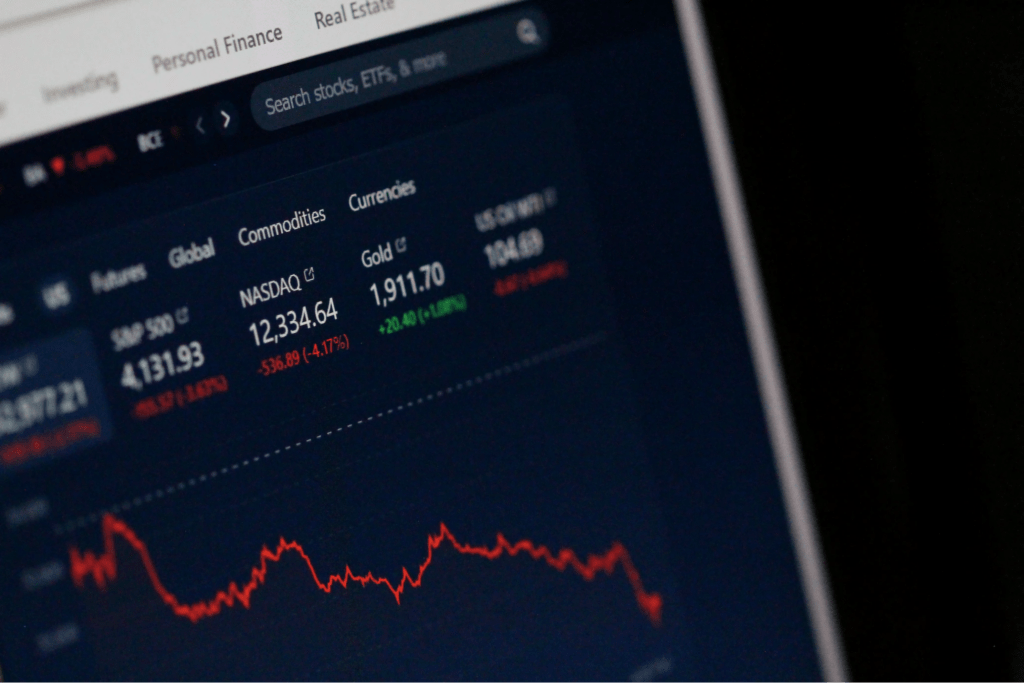

Featured image source: Chris Liverani