Start Building Your Child’s Credit

Getting children interested in financial matters can be challenging. You need to explain concepts they can’t visualize easily, which might make the child disengaged. On top of everything they learn at school, your child may not be keen on having additional lessons at home.

Gamification of the learning process is an excellent way to overcome this issue and ensure your child enjoys the experience. You can find numerous money games for kids that will help them develop a range of skills, and this article highlights some of the best options for children of different age groups.

How Kids’ Money Games Improve the Learning Experience

Besides being a fun teaching tool, games help your child retain new information and apply it to real-life situations. Research shows that board games are an effective way to increase knowledge of a certain topic and improve a child’s cognitive functions.

Other benefits of gamification include the following:

- Instant feedback—Games are interactive, so your child instantly sees the results of the knowledge they apply

- Increased engagement—Achieving mini-goals, progressing through levels, and other elements of games keep your child engaged throughout the learning process

- Better problem-solving—Instead of merely repeating the theoretical knowledge they get, your child can see its practical implications

These benefits apply to online and board games, and using a mix of the two is a great way to enrich your child’s money lessons.

Board Games About Money for Kids

If you want to turn money talks into a fun family pastime, board games can be highly beneficial. Among numerous options, three games stand out:

- Buy It Right

- Money Bags

- CASHFLOW

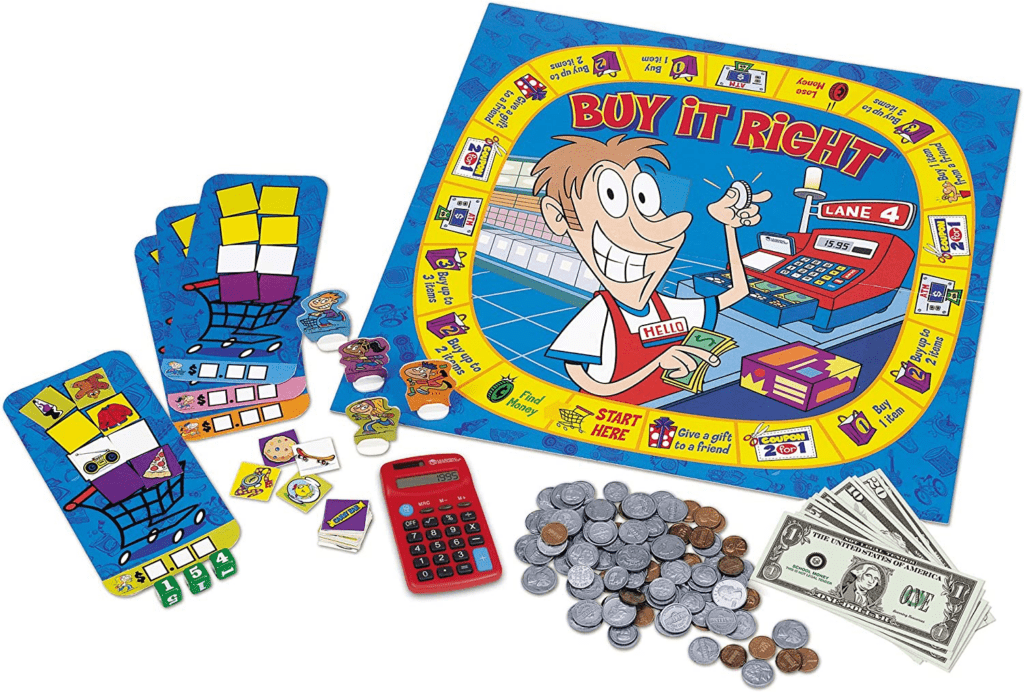

Buy It Right

Source: Amazon

Buy It Right is an excellent educational game that helps your child understand the value of money. It can also be quite helpful in teaching them how to manage their allowance. The following table breaks down its basic information:

| Basic Info | Details |

| Recommended age | 5+ |

| Number of players | 2–4 |

| Skill focus | Trading and money recognition |

You can set prices for specific items you’ll trade as you move through the board. This gives your child a chance to develop several skills, most notably:

- Counting money and making change

- Recognizing different U.S. bills and coins

- Buying and selling products

Everything you need is included in the bundle, so your child can start learning immediately.

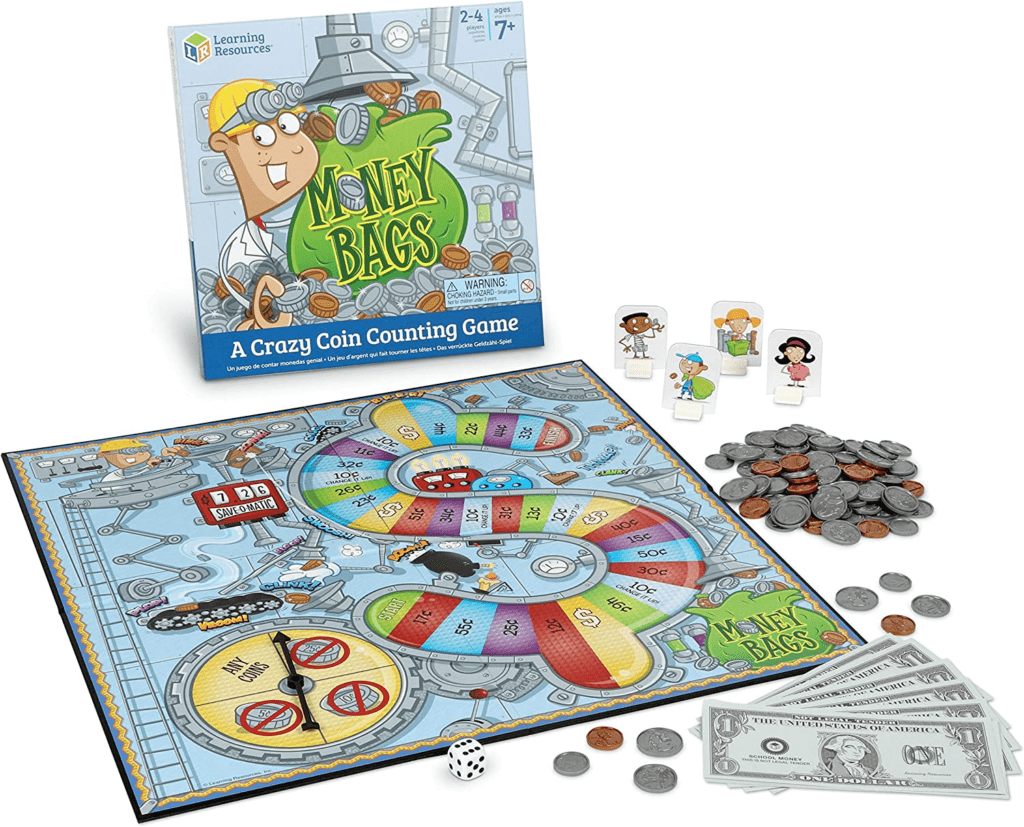

Money Bags

Source: Amazon

Money Bags is a fast-paced game that teaches your child the basics of collecting and counting money. You can find the relevant details in the following breakdown:

| Basic Info | Details |

| Recommended age | 7+ |

| Number of players | 2–4 |

| Skill focus | Money counting and recognition |

The gameplay is simple yet fun enough to keep your child engaged—they roll the dice and collect money based on the field they land on. This lets them practice early math while improving their money recognition skills.

The built-in spinner highlights coins that can’t be taken from a bank, so your child will need to work around these limitations to gather money, which improves their critical thinking.

CASHFLOW

Source: Rich Dad

Formerly known as CASHFLOW 101, this game was developed by Robert Kiyosaki, the famous author of Rich Dad, Poor Dad. It’s suitable for slightly older children, as you’ll see in the below table:

| Basic Info | Details |

| Recommended age | 10+ |

| Number of players | 2–6 |

| Skill focus | Financial management |

With the gameplay of around three hours, this game teaches children about numerous aspects of wealth-building and wise financial management, most notably:

- Developing good financial habits

- Investing

- Building passive income

Besides some key financial management skills, your child can learn some of Kiyosaki’s best-known concepts presented in a fun, digestible way.

Online Money Games for Kids

Children get accustomed to technology early on, so you’ll want to make sure they use it for good purposes. You can find many educational money games online, such as:

- Cash Puzzler

- Peter Pig’s Money Counter

- Toy Shop

Cash Puzzler

Source: Cash Puzzler screenshot

Cash Puzzler is a simple puzzle/memory game that helps children identify and memorize U.S. denominations. Like other online options from the list, it’s a single-player game, and other features are as follows:

| Basic Info | Details |

| Recommended age | 3–6 |

| Skill focus | Money recognition |

The objective is as simple as it gets—your child should put together the chosen banknote from scrambled pieces. When they do, they’ll learn some interesting facts about the person on the banknote.

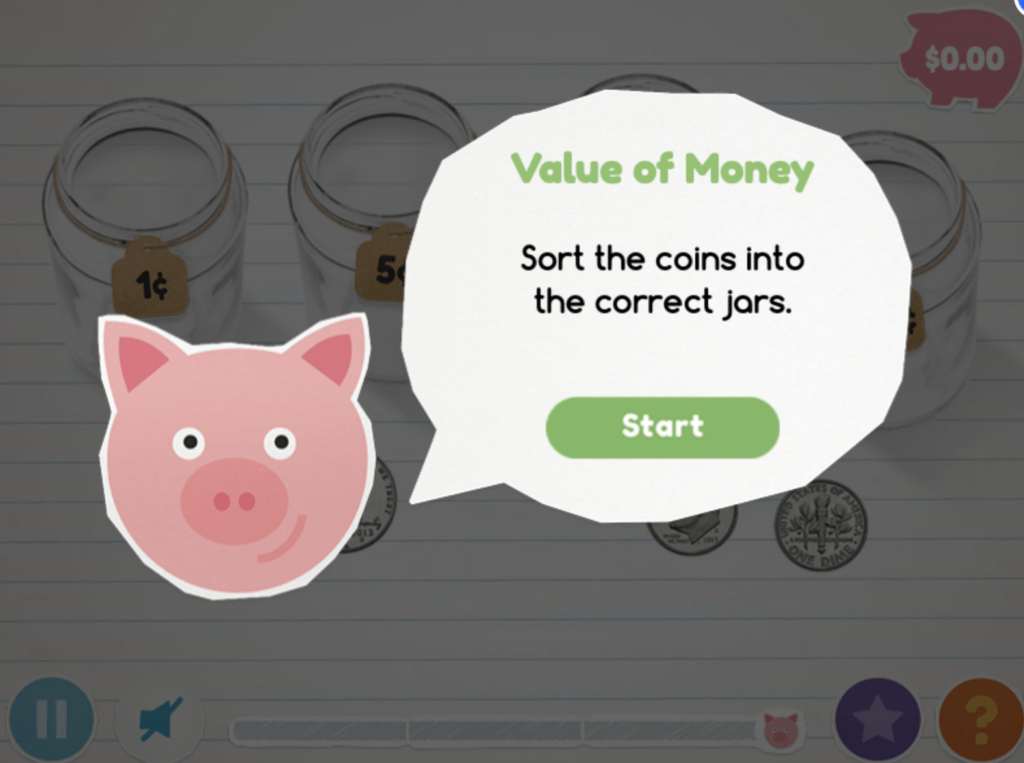

Peter Pig’s Money Counter

Source: Peter Pig’s Money Counter screenshot

Peter Pig’s Money Counter is a versatile game that uses rewards to motivate children to keep practicing. It focuses on two key aspects of early money management, as shown in this breakdown:

| Basic Info | Details |

| Recommended age | 5–8 |

| Skill focus | Coin recognition, money counting |

The game has three levels focused on coin identification and counting. Each time your child gets it right, they earn the amount represented by the coins. At the end of the game, they can buy items and dress up Peter Pig, which certainly adds some fun to the experience.

More importantly, the game prompts the child to save a certain amount of money before entering the store, which teaches children the value of prioritizing saving over spending.

Toy Shop

Source: Toy Shop screenshot

This game acts as a virtual store, letting your child buy toys by paying a specific amount from bills and coins of different values. It has two difficulty levels, which makes it suitable for a wider age group, as shown below:

| Basic Info | Details |

| Recommended age | 4–11 |

| Skill focus | Money counting |

Your child will see a toy with a price tag, and they must count their money so that it matches the requested amount. You can choose between a single-coin/bill budget or a mixed one depending on your child’s skill level and age. The game will help them understand the value of money and improve basic math skills.

How To Support Your Child’s Financial Literacy as They Grow Up

The games you saw here should help your child grasp the fundamentals of financial management. They’ll have a solid foundation for future knowledge they’ll need while growing up. As your child reaches their teens, you’ll need to educate them on new financial products and concepts, such as the following:

- Different types of bank accounts

- Debit and credit cards

- Saving and responsible spending

Besides the above, there’s one topic you’ll need to pay special attention to—credit building.

The Importance of Building a Strong Credit Profile

Your child’s credit profile can make or break their chances of obtaining loans and other credit products. It can also impact their place of residence and even their eligibility for certain jobs. With this in mind, your child should start working toward a good credit score as soon as possible.

They’ll likely need your support at the beginning, as children typically don’t qualify for financial products that let them build a credit history.

One way to support your child is to add them as an authorized user of your credit card. Some parents go down this road because the CARD Act of 2009 makes it almost impossible for children under 21 to obtain credit cards independently.

Adding a child as an authorized user lets you overcome this limitation and create a credit profile for them sooner. The problem is that there’s no long-term benefit because your child only builds a credit profile while they’re registered as an authorized user. When you remove them, they have to start over because all credit history associated with the card gets deleted from their profile.

If you need a more convenient and effective way of helping your child build a stellar credit profile, FreeKick can help.

Go Beyond Financial Education With FreeKick

While it’s important to provide your child with a financial education, you also need to take solid steps to give them a bright financial future, such as building their credit profile and protecting their identity. FreeKick by Austin Capital Bank is an FDIC-insured deposit account that offers both of these services.

FreeKick’s Credit Building Service

All children aged 13 to 25 can benefit from FreeKick’s credit building service. To reap its advantages for your child, take the following steps:

- Create an Account—Sign up on FreeKick.bank and choose a deposit that suits your budget

- Set It and Forget It—FreeKick will start building 12 months’ worth of credit history for your children

- Keep Growing—After 12 months, either close the account without any fees or continue building credit for your child for another year

With these simple steps, your child can have up to five years of credit history once they turn 18. This will help them save $200,000 during their lifetimes as they’ll be able to secure loans on favorable terms.

FreeKick’s Identity Protection Service

Credit building is incomplete without identity protection. Child identity theft occurs every 30 seconds, and if your children fall victim to it, their credit profiles can suffer significant damage. This is why it’s a good idea to invest in FreeKick’s identity protection service, which offers the following features for minors:

- Credit profile monitoring

- Social Security number (SSN) monitoring

- Dark web monitoring for children’s personal information

- Up to $1 million identity theft insurance

- Full-service white-glove concierge credit restoration

- Sex offender monitoring—based on sponsor parent’s address

FreeKick also offers identity protection for adult children and parents via the following features:

- Credit profile monitoring

- SSN monitoring

- Dark web monitoring for personal information

- Up to $1 million identity theft insurance

- Full-service white-glove concierge credit restoration

- Lost wallet protection

- Court records monitoring

- Change of address monitoring

- Non-credit (Payday) loan monitoring

- Free FICO® Score monthly

- FICO® Score factors

- Experian credit report monthly

FreeKick Pricing

FreeKick has two pricing plans:

| FDIC-Insured Deposit | Annual Fee |

| $3,000 | $0 (Free) |

| No deposit | $149 |

With both plans, you get:

- Credit building for six children aged 13 to 25

- Identity protection for two parents and six children aged 0 to 25

Secure your child’s financial future through good credit and a protected identity—sign up for FreeKick today.

Featured image source: Joshua Hoehne

Freekick provides a double dose of financial empowerment and security for your whole family. It helps teens and young adults build strong credit profiles and offers identity motoring for up to two adult parents and six children under 25.