Start Building Your Child’s Credit

Coming up with gift ideas for teens is often quite a challenge. If you’re not sure what to get them, giving them money is always a safe bet. Your teen can decide how best to spend it, and you’ll rest assured knowing that they got what they wanted.

Still, many people are hesitant to give money because they believe cold cash doesn’t fit the heartfelt atmosphere of gift-giving. This guide breaks such misconceptions by showing you some creative ways to give money to a teenager. You’ll see some out-of-the-box ideas that attach more meaning to dollar bills, as well as some that don’t involve cash at all.

Why Money Is an Excellent Gift for Teens

Before covering some fun ways to give money to a teenager, it’s worth explaining why it’s such a good gift in the first place. There are several arguments in favor of gifting money to teens, most notably:

- No risk—With most gifts, there’s at least a small chance of getting it wrong—clothes may not fit, a video game might be the one they have already played or don’t like, and so on. Money is a universal gift, so it doesn’t carry such risks

- Flexibility—Your teen has countless options for using the money they receive. They can save it or spend it on whatever they way, be it a product or experience they enjoy

- Popularity—According to Intuit’s survey, 61% of Americans choose money over traditional gifts, which confirms that it’s hard to go wrong with it

Giving your teen money for their birthday or Christmas doesn’t mean you can’t make it festive and unique. There are numerous ways to ensure that money has both intrinsic and sentimental value.

Money Gift Ideas for Teenagers Your Child Will Remember

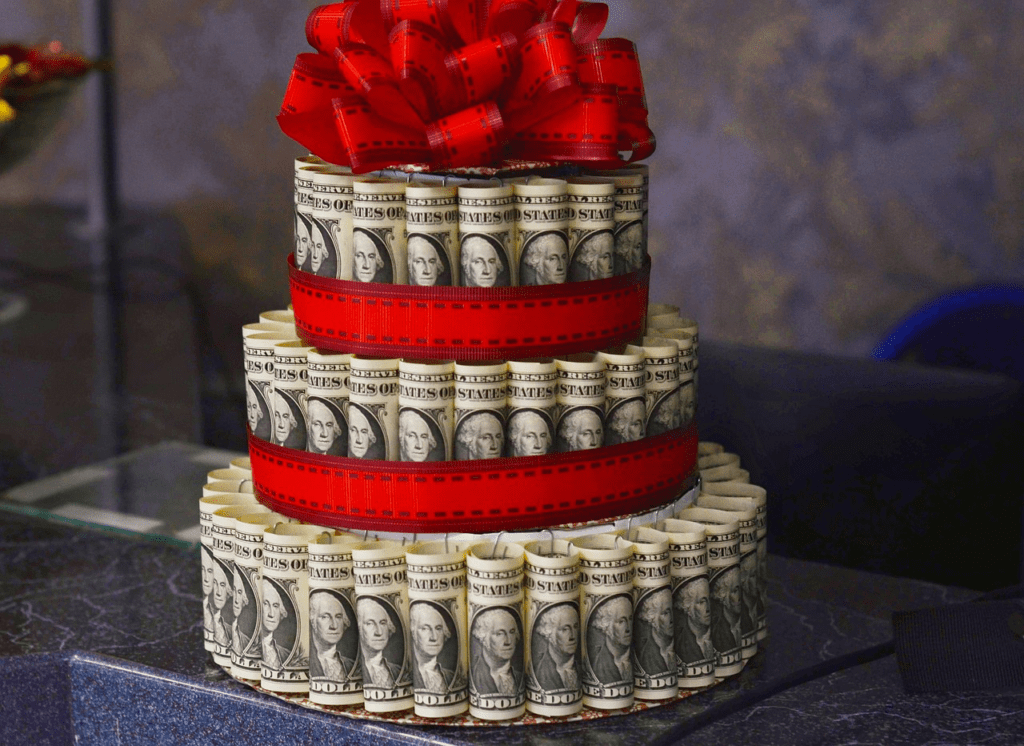

Source: gorartser

If you need some inspiration for a unique approach to gifting money, the following suggestions are worth considering:

- Conceal the money to surprise your child

- Organize a scavenger hunt

- Build the gift into a board game

- Get your teen their first debit card

- Make an investment in their name

The best method will depend on your goal and the child’s age, so the following breakdowns of each will help you decide—or at least give you a general direction to go in.

Turn Cash Into a Surprise

If your mind is set on gifting cash, and you don’t want any over-the-top way to do it, adding a small element of surprise could be enough to delight your child. You can hide it into another gift or anything that doesn’t have a significant monetary value but still adds some fun to the overall experience.

For instance, you can fill a jar with candy and hide the money in it. You can also place it between random pages of a book so that the teen stumbles upon it unexpectedly. Your options are virtually endless, so find something your child will enjoy the most.

Set Up a Scavenger Hunt

Source: N.

This option is excellent for tweens and young children, though older teens might thoroughly enjoy it as well. Scavenger hunts can be a blast, and gamifying gift-giving makes it more memorable.

You can spread the money around different parts of your home or backyard and then leave clues for your child. As they go around collecting the cash, they’ll be increasingly happy about the amount they received.

Use a Board Game To Let the Child “Earn” the Gift

If you want to add some excitement to your child’s gift and enrich the celebration, a board game is a great approach. Besides spending some quality family time, it lets you turn the gift into a reward.

Place the money on different spots on the board game, or create new rules that would let your child earn it. Of course, you’ll let the child win and take it all—they just won’t know it.

Take the Money as an Opportunity for a Debit Card

Source: Nathana Rebouças

If it’s time for your child to move away from cash and get introduced to the banking system, the money you give them won’t only be a gift—you can use it to take their financial literacy to a new level through a debit card.

Checking accounts aren’t available to everyone, so if your child is still in their early teens, a prepaid card can be a solid alternative. Load the card with the amount you wish to gift—your child will certainly be excited about receiving money through their own card.

More importantly, this will be a teachable moment they can benefit from in various ways. Besides having a new method of receiving their allowance, your child will be one step closer to financial independence.

Invest on Your Child’s Behalf

Fidelity’s recent survey shows that 20% of teens invest their money, while 55% believe it’s too confusing. If you want your teen to have a gift that keeps giving (quite literally), you can use the money to invest in various assets, such as:

- Stocks

- Bonds

- Mutual funds

You can either open a custodial account for your child and place the assets in it or help your teen get their own brokerage account if they qualify. In any case, your child’s gift will grow with time and might get them interested in investing.

Bonus: Give Your Child the Gift of Financial Stability

As you saw, there’s so much more to money gifts than cash. If you think outside the norm, you can put that money to good use in numerous ways. Besides being a thoughtful gift, it can support your child’s independence and prepare them for adulthood.

If you need another financial gift that will pay itself off for decades to come, you can invest in your child’s credit profile. A good credit score has numerous benefits, from easier loan approval to significant savings throughout adulthood.

The reason a parent’s help is invaluable in building a credit profile is that most teens can’t obtain financial products that would allow them to do it independently. If your child is younger than 21, they can’t get a credit card unless they meet one of the two conditions imposed by the CARD Act of 2009:

- Demonstrating an independent ability to repay the debt

- Having a co-signer over 21 who can be held responsible for the card

While you can get around it by adding a child as an authorized user of your credit card, this isn’t a good long-term solution. Your child would get a credit profile, but they would inherit your credit history and only build credit while being registered as a user. They’d need to start over when you remove them, as all credit history associated with the card gets removed from their profile.

If you need a gift that will contribute to your child’s financial stability in the long run, FreeKick is an excellent choice.

Go Beyond Financial Education With FreeKick

While it’s important to provide your child with a financial education, you also need to take solid steps to give them a bright financial future, such as building their credit profile and protecting their identity. FreeKick by Austin Capital Bank is an FDIC-insured deposit account that offers both of these services.

FreeKick’s Credit Building Service

All children aged 13 to 25 can benefit from FreeKick’s credit building service. To reap its advantages for your child, take the following steps:

- Create an Account—Sign up on FreeKick.bank and choose a deposit that suits your budget

- Set It and Forget It—FreeKick will start building 12 months’ worth of credit history for your children

- Keep Growing—After 12 months, either close the account without any fees or continue building credit for your child for another year

With these simple steps, your child can have up to five years of credit history once they turn 18. This will help them save $200,000 during their lifetimes as they’ll be able to secure loans on favorable terms.

FreeKick’s Identity Protection Service

Credit building is incomplete without identity protection. Child identity theft occurs every 30 seconds, and if your children fall victim to it, their credit profiles can suffer significant damage. This is why it’s a good idea to invest in FreeKick’s identity protection service, which offers the following features for minors:

- Credit profile monitoring

- Social Security number (SSN) monitoring

- Dark web monitoring for children’s personal information

- Up to $1 million identity theft insurance

- Full-service white-glove concierge credit restoration

- Sex offender monitoring—based on sponsor parent’s address

FreeKick also offers identity protection for adult children and parents via the following features:

- Credit profile monitoring

- SSN monitoring

- Dark web monitoring for personal information

- Up to $1 million identity theft insurance

- Full-service white-glove concierge credit restoration

- Lost wallet protection

- Court records monitoring

- Change of address monitoring

- Non-credit (Payday) loan monitoring

- Free FICO® Score monthly

- FICO® Score factors

- Experian credit report monthly

FreeKick Pricing

FreeKick has two pricing plans:

| FDIC-Insured Deposit | Annual Fee |

| $3,000 | $0 (Free) |

| No deposit | $149 |

With both plans, you get:

- Credit building for six children aged 13 to 25

- Identity protection for two parents and six children aged 0 to 25

Secure your child’s financial future through good credit and a protected identity—sign up for FreeKick today.

Featured image source: Karolina Grabowska

Freekick provides a double dose of financial empowerment and security for your whole family. It helps teens and young adults build strong credit profiles and offers identity motoring for up to two adult parents and six children under 25.