A Guide to Requesting an Experian Minor Credit Freeze

Start Building Your

Child’s Credit

A credit report is a highly sensitive document that can make or break a person’s ability to obtain credit. It also contains private information, including a consumer’s address, date of birth, and Social Security number (SSN). Because there is no good reason for an unknown person, lender, or company to access a minor’s credit report, many parents choose to freeze or lock their children’s credit profiles.

Getting a credit freeze is a good way to keep your child’s information safe and prevent the unauthorized opening of new credit accounts in their name. All major credit bureaus offer it, but this guide will mainly focus on the Experian minor credit freeze as one of the most common options. You’ll also learn how other bureaus approach this matter and what you can do to safeguard your child’s information and identity.

What Is a Minor Credit Freeze?

A credit freeze works the same way for minors and adults. When you freeze a credit profile, it becomes inaccessible to new creditors and third parties. You can’t open a new credit account before unfreezing the report.

This doesn’t mean nobody can access the report. It may still be visible to:

- Existing creditors

- Collection agencies

- Government agencies

This shouldn’t be a problem because the point of a credit freeze isn’t to conceal information from these institutions but to prevent unauthorized access and new accounts from being created under the user’s name.

When Should You Request a Minor Credit Freeze?

Many people freeze credit reports to prevent taking out new credit or making hard inquiries impulsively. This isn’t an issue with minors, as most can’t get credit independently anyway. The CARD Act of 2009 made it difficult for anyone under 21 to obtain a credit card, and other financial products are almost impossible to obtain when you’re not an adult.

A more common reason to freeze your child’s credit report is to lower the risk of identity theft—or mitigate its consequences if your child has already fallen victim to it.

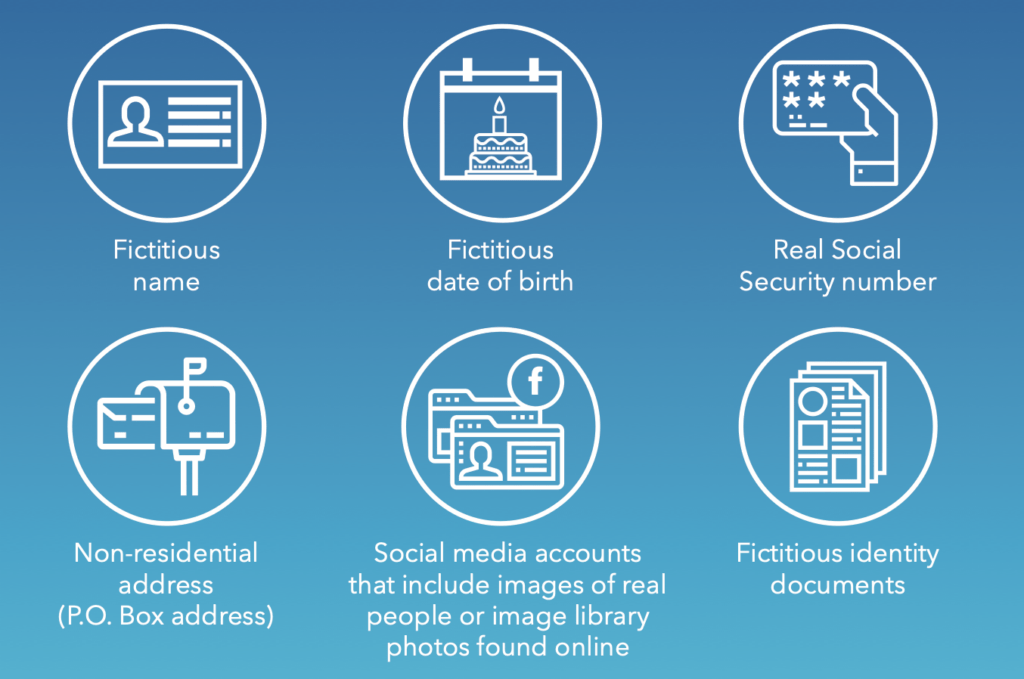

Identity theft affects one in 50 U.S. children and can have severe consequences. Minors’ identities typically aren’t monitored, so their sensitive data, like SSNs, can be exploited for synthetic identity fraud. Synthetic identity fraud is when the fraudster combines a real SSN with a fake name and other information to create a new identity for a person that does not exist and use it to open new credit accounts. The following breakdown from the Federal Reserve’s report outlines the components of these fake identities:

Source: The Federal Reserve: Synthetic Identity Fraud in the U.S. Payment System

If someone steals your child’s SSN, they can borrow funds in their name. Every new lender will ask for a credit report to assess the borrower’s reliability, so a fraudster can leverage your child’s file by using their personal information. As a credit freeze makes the report inaccessible to new lenders, it can prevent the creation of fraudulent accounts.

How To Request an Experian Child Credit Freeze

The simplest way to freeze a minor’s credit report with Experian is to fill out the form on the bureau’s Child Identity Theft Protection portal. You’ll see three options:

- Check if a minor has a credit report

- Add a fraud alert for a minor

- Add or remove a security freeze for a minor

Click on the third (right-most) option, and provide the requested information.

Source: Experian Child Identity Theft Protection

Besides your information, you’ll need to provide your child’s data, including their address, birth date, and SSN. When you complete the form, you will need to print it out and mail it to Experian Security Freeze, P.O. Box 9554, Allen, TX 75013. Under the form, you’ll see which additional documentation you must include, so make sure you have everything.

Experian also has a dedicated credit freeze page you can use to submit a request online, but you can only do it for your own credit report. The bureau doesn’t keep records of minors’ credit, so your child would have to be a legal adult with an Experian account to use this service.

Note that an Experian credit freeze doesn’t extend to other bureaus, so you’ll have to repeat this process and submit separate requests to:

- TransUnion

- Equifax

How To Place a TransUnion Credit Freeze on a Minor

Unlike Experian, TransUnion doesn’t have a specific credit freeze form you can fill out. You need to mail them a written request for the so-called “protected consumer freeze” alongside the following documentation:

- A document serving as proof of authority (copy of the child’s birth certificate, court order, power of attorney, etc.)

- Copy of documents proving your identity

- Proof of your child’s identity

You can mail the form to TransUnion, P.O. Box 380, Woodlyn, PA 19094. You can’t request a freeze via phone or email because you must provide hard copies of the above documentation.

The process might be more complex than Experian’s because there’s no form you can use to ensure you have all the right information. If you need help structuring the written request, you can use this template from the Maryland Attorney General.

If you want to check if your child has a credit report with TransUnion, you can submit a Child Identity Theft Inquiry. The bureau will check the database to see if there’s a credit file in your child’s name so that you can proceed accordingly.

Submitting a Credit Freeze Request to Equifax

To freeze your child’s credit file with Equifax, fill out the Minor Security Free Request Form. You must download the form and include the necessary information alongside the accompanying documents. The required documentation is similar to what other bureaus request and boils down to identity and authority proof.

When you fill out the form and gather the documentation, mail it to Equifax Information Services LLC, P.O. Box 105788, Atlanta, GA 30348-5788.

Note that the above process applies to children under 16. Older minors can request a freeze independently via mail or phone. If your child is over 18, they can freeze their credit file online through the myEquifax account.

What To Know Before Requesting a Credit Freeze for a Minor

Now that you understand the process of freezing your child’s credit files, it’s time to discuss some important details you should keep in mind:

- Credit freeze costs

- Notice and timelines

- Effect on the credit score

How Much Does a Credit Freeze Cost for Minors?

In May 2018, Congress passed legislation requiring all three major consumer credit bureaus to offer free credit freezes to consumers, and this extends to freezing your child’s report.

Note that this rule doesn’t apply to employment-screening companies and similar institutions that can perform credit reporting for different purposes. Credit freezes are typically free.

When Will the Freeze Take Effect?

Credit freezes are governed by federal law, which requires bureaus to complete the process within three business days after receiving the request and documentation via mail. If you request a freeze by phone, it must take effect within an hour.

The credit bureau is also obligated to provide a written confirmation of the freeze within five business days from the moment it’s placed. The confirmation should also include steps for unfreezing the file. You’ll likely get a PIN you’ll need to provide before the freeze is lifted, so store it securely.

Does a Credit Freeze Affect Your Child’s Score?

Source: PabitraKaity

As a parent concerned about their child’s financial future, it’s normal to wonder if a credit freeze will damage your child’s score once they start building credit. After all, many credit issues can stay on the report for years.

The good news is that a credit freeze doesn’t impact the score. When your child meets the age requirements and other conditions for starting a credit profile, they can build it without restrictions.

Remember that your child won’t be able to take out credit until the freeze is lifted. This may not be an immediate concern if they’re still too young, but it’s worth keeping in mind if you plan on helping your kid build credit when the time comes.

Minor Credit Freeze Alternatives To Consider

A credit freeze isn’t the only way to keep your child’s report safe. You can also:

- Request a credit lock

- Put a fraud alert on the report

Credit Freeze vs. Credit Lock

A credit lock might be suitable if your child has a valid credit report. You can place it to prevent identity theft or haphazard credit inquiries once your child is old enough to make them.

Before that happens, the main legitimate reason for your child to have a report is if you’ve added them to your credit card as an authorized user. In this case, you can lock your report to automatically lock theirs.

When your child becomes an adult and starts having their own financial products, you can advise them to lock the report as they must do it independently.

A credit lock serves the same purpose as a freeze, though there are some slight differences between the two:

| Feature | Credit Freeze | Credit Lock |

| Cost | Free with all consumer bureaus | All three bureaus (Equifax, Experian, and TransUnion) have monthly subscription plans that include credit locks with monthly fees, but you can lock your credit independent of each plan for free |

| Governed by | Federal law | Service agreements |

| Typical use | Preventive and remedial | Mainly preventive |

A credit lock is an optional add-on offered and managed by each bureau, which is why they are allowed to charge for it. The main reason some users choose it over freezing is convenience since requesting and managing a lock can typically be done online or by phone.

Placing a Fraud Alert on Your Child’s Report

If you believe your child is at risk of identity theft or already an identity fraud victim, you can place a fraud alert with any of the bureaus. The alert will be visible to all creditors and serve as a red flag, encouraging them to take extra steps to verify the user’s identity before offering credit.

A fraud alert is free, and you only need to contact one of the bureaus to place it. They’ll notify the other two, so your child will get comprehensive protection right away.

The alert will last for one year, but you can request an extended seven-year alert if you have a Federal Trade Commission Identity Theft Report or a police report confirming your child’s identity has been compromised. When the danger has passed, you can remove the alert by mail or phone.

Prevention Is the Best Medicine

A credit freeze is the most effective when used as a preventive measure. The problem is that many people freeze their child’s report after their identity has been stolen and the damage is already done.

As your child most likely doesn’t have a credit report unless they’re an authorized user of your card, a preventive freeze would involve the bureau creating a report and freezing it immediately. A frozen report is inaccessible to new lenders, so this would prevent your child from building their credit score until the freeze is lifted.

Luckily, you can protect your kid’s identity without limiting their credit opportunities. If you want to minimize the chances of credit profile fraud while helping your child establish a strong credit profile, FreeKick is the best way to go about it.

FreeKick—Simple Credit Building and Credit Profile Protection for Children and Young Adults

Powered by Austin Capital Bank, a Federal Deposit Insurance Corporation-insured (FDIC-insured) bank, FreeKick combines an FDIC-insured deposit account and additional services to:

- Help children and young adults establish a credit profile

- Monitor their credit profile for signs of identity fraud

How FreeKick Helps Your Child Establish a Credit Profile

If you want to give your child a financial head start, FreeKick lets you do it without tedious ongoing actions. All you have to do is:

- Create an Account—Go to FreeKick.bank, sign up for an account, and choose a deposit that suits your budget

- Set It and Forget It—FreeKick will start building 12 months’ worth of credit history for your child

- Keep Growing—After 12 months, you can either close the account without any fees or choose to continue building credit for your child for another year

FreeKick understands that parents are tired of monthly subscriptions, so you can get a free plan with a one-time deposit or choose another plan with no deposit and an affordable annual fee:

| FDIC-Insured Deposit | Annual Fee |

| $3,000 | $0 (Free) |

| No deposit | $149 |

If your child is a legal adult, FreeKick will automatically start building their credit profile and report all credit activity to the three major credit bureaus for the next 12 months. For children under 18 (minors), FreeKick builds credit while they are minors and then reports it when they become adults and activate credit reporting.

This way, your child can enter adulthood with an established credit history, which can be a significant advantage. A strong credit profile can save young adults over $200,000 throughout their life.

You can cancel the account at any point, but if you do it before your child becomes an adult and activates credit reporting, no credit can ever be reported for the account because the consumer credit bureaus do not allow credit reporting for minors.

Effective Identity Theft Detection Through Credit Monitoring

A credit freeze can be complex and time-consuming. As the government doesn’t oversee your child’s SSN and other sensitive data, you’d have to be on a constant lookout for signs of identity theft.

As a parent, you have enough responsibilities without such a daunting task. That’s why FreeKick includes credit profile monitoring to give you peace of mind.

| Services for Minors | Services for Adult Children and Parents |

| Credit profile monitoring Social Security number (SSN) monitoring Dark web monitoring for children’s personal information Up to $1 million identity theft insurance Full-service white-glove concierge credit restoration Sex offender monitoring—based on sponsor parent’s address | Credit profile monitoring SSN monitoring Dark web monitoring for personal information Up to $1 million identity theft insurance Full-service white-glove concierge credit restoration Lost wallet protection Court records monitoring Change of address monitoring Non-credit (Payday) loan monitoring Free FICO® Score monthly FICO® Score factors Experian credit report monthly |

To help your child enjoy a more financially secure future and reduce the chances of undetected identity fraud, sign up for FreeKick.

Featured image source: TheDigitalWay