A Quick Guide to Placing a TransUnion Minor Credit Freeze

Start Building Your

Child’s Credit

All three major credit bureaus—Experian, Equifax, and TransUnion—let users freeze their credit profiles. Some people do it to stop themselves from obtaining unnecessary credit, while others use it as a precaution to safeguard their sensitive information.

Freezing your own profile is relatively straightforward, but doing it for a child can be more complicated. This guide will focus on the TransUnion minor credit freeze to give you all the information you need to ensure your children’s credit information is safe. You’ll learn the following:

- How a credit freeze works, and who needs one

- How to freeze your child’s credit profile with TransUnion

- What credit freeze alternatives you should explore

What Is a Credit Freeze (And Why Should You Request One for Your Child)?

A credit freeze is a security measure that prevents new lenders and most third parties from accessing your credit profile. You can’t obtain additional credit while the freeze is active, and your credit information won’t be accessible to others—with some exceptions. Some institutions can still access your profile, most notably:

- Existing lenders

- Collection agencies

- Government agencies in specific circumstances

- Companies you’ve authorized to provide you with details of your credit report

These exceptions aren’t concerning because a credit freeze isn’t supposed to conceal credit information from the above institutions. Its main purpose is to stop malicious parties or unauthorized users from opening new credit accounts in the holder’s name.

As far as minors are concerned, they can’t build credit independently, so a credit freeze may seem unnecessary for many parents. This is a common misconception—and a dangerous one—as children’s inability to seek credit is the exact vulnerability financial criminals exploit.

Child Identity Theft—A Rising Issue

Source: Nikita Belokhonov

Minors’ sensitive information—particularly Social Security Numbers (SSNs)—is largely unused and unmonitored. This leaves room for an elaborate crime that affects numerous children—synthetic identity fraud.

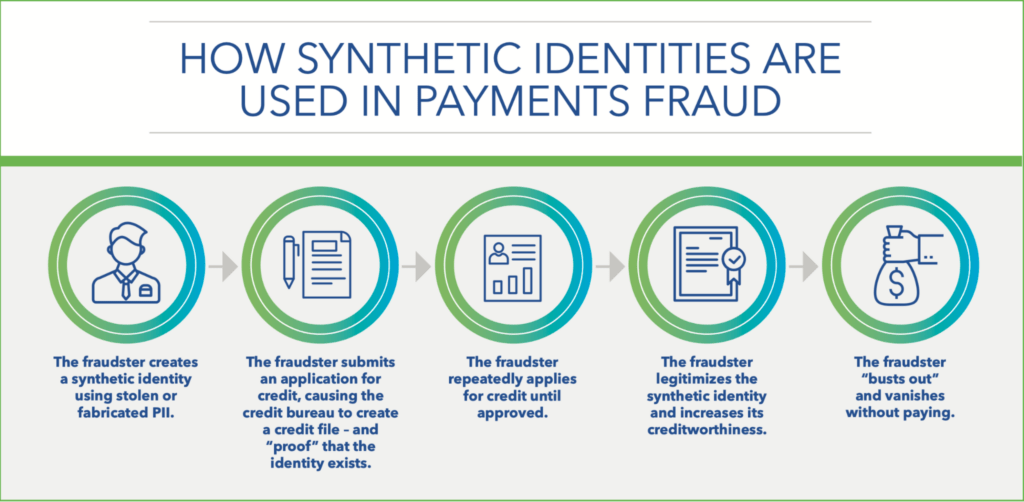

Unlike typical impersonation, synthetic identity fraud involves a mix of a minor’s private information and fake personal details for the creation of a new identity. The perpetrator uses the identity to open fraudulent credit accounts and scam lenders. The following diagram from the Federal Reserve’s whitepaper on synthetic identity fraud explains this process in more detail:

Source: The Federal Reserve: Detecting Synthetic Identity Fraud in the U.S. Payment System

Placing a credit freeze on your child’s profile may help you protect their information or mitigate the consequences of an existing theft. It prevents new accounts from being opened in your child’s name so that their SSN isn’t tied to fraudulent activity or excessive debt.

How To Request a TransUnion Child Credit Freeze

TransUnion lets users place a “protected consumer freeze” on their children’s credit profiles. Unlike freezing your own profile, the process isn’t possible through an online service or phone—you need to submit a written request.

Alongside the request, you need to provide the following:

- Proof of authority showing that you’re allowed to request the freeze in your child’s name (e.g., a court order, power of attorney, or proof of parentage)

- Copies of government-issued documents proving your and your child’s identities (e.g., a birth certificate, driver’s license, or Social Security card)

You should mail the above to TransUnion, P.O. Box 380, Woodlyn, PA 19094.

If your child has a credit profile, TransUnion will freeze it within three business days, as mandated by the governing legislation. If they don’t have one, the bureau will create a profile and freeze it immediately.

Note that a credit freeze placed with one bureau doesn’t extend to the others. Your child’s profile will still be accessible through Equifax and Experian, so you’ll need to request the freeze from these bureaus separately. Both bureaus have specific forms you need to fill out and send together with proof of authority and identity to the following addresses:

| Credit Bureau | Mailing Address |

| Experian | Experian Security Freeze P.O. Box 9554 Allen, TX 75013 |

| Equifax | Equifax Information Services LLC P.O. Box 105788 Atlanta, GA 30348-5788 |

Requesting a credit freeze from all three credit bureaus can be complicated and time-consuming, so many parents don’t do it unless there’s a specific need to protect their children’s information.

Signs Your Child Might Need a Credit Freeze

Source: RDNE Stock project

Child identity theft can go unnoticed, preventing parents from taking action on time. To ensure this crime doesn’t do excessive damage, request a credit freeze immediately if you notice any of the following red flags:

- Pre-approved credit card offers addressed to your child

- An existing credit profile without a legitimate credit history

- Denial of government benefits as a result of the child’s information having been used to obtain them

Of course, you can request a credit freeze proactively even if there are no signs of your child’s identity being compromised. The issue is that doing so can prevent them from establishing a genuine credit history, as they can’t open any credit accounts until the freeze is removed.

To keep your child’s information safe without limiting their future creditworthiness, you might want to consider certain measures beyond a credit freeze.

What Is the Best Alternative to Submitting a Minor Credit Freeze?

There are two common alternatives to a credit freeze:

- Fraud alert

- Credit lock

If you believe your child may have fallen victim to identity theft, you can request a fraud alert instead of a credit freeze. When the alert is placed on the child’s file, any attempt to open an account in their name will require a more extensive identity verification procedure.

A credit lock is similar to a freeze, except your child will have to place one themselves if they have a valid credit profile. This is typically done online through a dedicated service, and the child needs to have their own account (with each bureau) to lock their profile.

Secure as they may be, both of these methods are flawed. A fraud alert can’t proactively protect your child (as you’d place one after noticing fraudulent activity), while a lock places the same restrictions on your child’s credit-building efforts.

To fix these issues, Austin Capital Bank created a way for you to help your child establish a strong credit profile while ensuring it’s closely monitored at all times—FreeKick.

Use FreeKick To Build Your Child’s Credit and Protect Their Identity

With so many restrictions on minors obtaining credit cards, a service like FreeKick that provides credit building features is the workaround you need. Offered by Austin Capital Bank, FreeKick is an FDIC-insured deposit account that helps you build credit for your child while also protecting the identities of your whole family.

Three Steps for Using FreeKick’s Credit Building Service

FreeKick’s credit building service is available for children aged 13 to 25. Take the following three simple steps to help your child establish a credit history early on in life:

- Create an Account—Go to FreeKick.bank, sign up for an account, and choose a deposit that suits your budget

- Set It and Forget It—FreeKick will start building 12 months’ worth of credit history for your child

- Keep Growing—After 12 months, you can either close the account without any fees or choose to continue building credit for your child for another year

This service gives your child a credit head start of up to five years when they turn 18, which will help them save $200,000 during their lifetime through favorable loan terms and other financial perks.

How FreeKick Protects Your Child’s Identity

Child identity theft happens every 30 seconds, and without a secure identity, your child’s credit profile will be standing on a shaky foundation. This is why it’s important to invest in identity protection when you’re trying to give your children a bright financial future. FreeKick’s identity protection services include:

| Services for Minors | Services for Adult Children and Parents |

| Credit profile monitoring Social Security number (SSN) monitoring Dark web monitoring for children’s personal information Up to $1 million identity theft insurance Full-service white-glove concierge credit restoration Sex offender monitoring—based on sponsor parent’s address | Credit profile monitoring SSN monitoring Dark web monitoring for personal information Up to $1 million identity theft insurance Full-service white-glove concierge credit restoration Lost wallet protection Court records monitoring Change of address monitoring Non-credit (Payday) loan monitoring Free FICO® Score monthly FICO® Score factors Experian credit report monthly |

What FreeKick Costs

FreeKick offers two pricing plans:

| FDIC-Insured Deposit | Annual Fee |

| $3,000 | $0 (Free) |

| No deposit | $149 |

With both plans, you get:

- Credit building for six children aged 13 to 25

- Identity protection for two parents and six children aged 0 to 25

Say goodbye to credit card hassle and help your child establish a good credit profile—sign up for FreeKick today.

Featured image source: Scott Graham