How To Check Your Credit Score in High School (And How To Improve It)

Start Building Your

Child’s Credit

As teens reach adult age, many start thinking about credit for various reasons, purchasing a vehicle and college being among the key ones.

Whether you’re looking to assess your borrowing capacity or check your credit score to understand your starting point, this guide will help. We’ll show you how to check your credit score in high school and what it means to even have a report at this stage in life. You’ll also learn how to build a strong credit profile and set yourself up for a brighter future.

If you’re a parent looking to educate and help your teenagers build a solid financial future, you can find all the info you need and a practical solution!

Can a Minor Have a Credit Score, and How To Find Out if They Do

As high-school students are typically minors, standard credit reporting doesn’t apply to them. While building credit before reaching legal age is possible, reporting will only be activated once a child turns 18 (or 19 in Alabama).

You or your parents can reach out to the three major credit bureaus to request a report:

- Equifax

- Experian

- TransUnion

You can also use third-party services to get your credit report, but make sure to work with certified providers. The Federal Trade Commission recommends Annual Credit Report, which lets you get a free report once a year. You can fill out the request form and mail it to the service’s P.O. Box or request a report from their website.

If you are a minor and have a credit report, there are only two ways it could have been created:

- Your parent added you as an authorized user of their credit card

- Someone might have used your private information to forge a fake identity

Should Parents Add Children to Their Credit Cards?

High-school students typically don’t have access to financial products that would allow them to build a credit history. There’s a chance you won’t even be eligible for a credit card once you become an adult and go to college, as the CARD Act of 2009 made it difficult for young adults aged 18 to 20 to obtain credit cards.

Source: Andrea Piacquadio

Many parents know this and believe adding children to their credit cards is the best alternative. While this approach is preferable to not having a card at all, it suffers from a few significant drawbacks.

If your parent adds you to their credit card, you’ll inherit their credit score. Any red flags on their report also apply to you, so you might have trouble borrowing from the bank if their credit behavior is subpar.

You should also keep in mind that you only build a credit history for as long as the authorization is active. When your parent removes you from the card, all your credit history related to it will be wiped from your report.

Why High-School Students Are Vulnerable to Identity Fraud

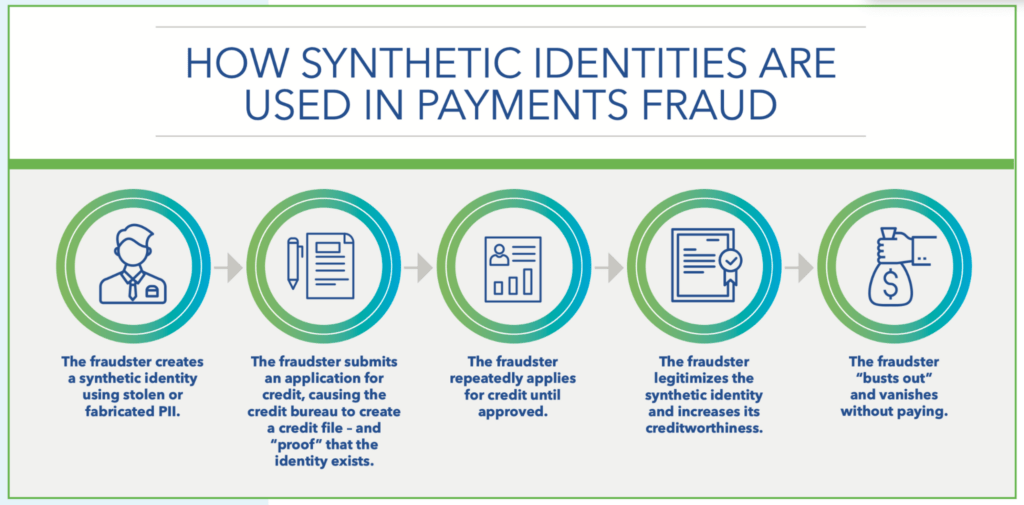

Minors are among the most common victims of synthetic identity fraud, alongside the homeless and the elderly. Unlike typical ID theft, where someone impersonates a real individual, synthetic fraud involves the creation of an entirely new identity. The fraudster combines fake information with real data like someone’s Social Security number (SSN), using the new identity to take out loans.

The following diagram from the Federal Reserve’s report explains how the process works:

Source: The Federal Reserve: Detecting Synthetic Identity Fraud in the U.S. Payment System

Synthetic identity fraud is difficult to detect, but it’s not impossible—you can do it by checking whether you have a credit report. If you haven’t used any financial products that would justify the existence of a credit report, chances are that someone might have stolen your information.

Other signs that someone might be using your personal information for financial fraud include:

- Receiving unknown bills in your name

- Calls from banks or collection agencies related to unpaid debt

- Denied government benefits as a result of your SSN having already been used to obtain them

Identity theft requires swift action and help from a restoration specialist. You’ll learn more about protecting yourself later in this guide.

How To Improve Your Credit Score

If you are an adult and have a credit score while still in high school, you can use it as the foundation of a solid credit profile. Here are some actionable tips for maximizing your score:

- Understand the contributing factors

- Maintain good credit-building practices

- Let a parent help

What Impacts Your Credit Score?

While there can be some slight differences between credit-scoring models, the key determinants of your credit score include:

- Payment history—Payment history has the largest impact on your credit score. It is a record of all your credit payments and shows whether they were made on time, late, or missed. A late or missed credit payment can hurt your score for up to seven years, so it’s critical to always make your credit payments on time

- The amount owed/credit utilization—The higher your outstanding loan amount, the lower your credit score, or the higher your utilization, the lower your score. Credit utilization under 30% should not harm your score, but keeping utilization under 10% is ideal

- Credit history length—Irrespective of other factors, your credit score should increase with the time you’ve been using financial products, and the longer your history, the better

- New credit applications—Applying for new credit haphazardly or too frequently might lower your credit score

- Credit mix—Your credit profile should have a mix of installment accounts (loans with set monthly payments) and revolving credit accounts (e.g., credit cards). Having both types of credit demonstrates to lenders that you know how to responsibly manage multiple types of credit

Depending on these factors, your credit score can range between 300 and 850. The score is categorized as follows:

| Category | Score |

| Poor | 300–579 |

| Fair | 580–669 |

| Good | 670–739 |

| Very Good | 740–799 |

| Exceptional | 800–850 |

Maintain Healthy Spending Habits

The whole point of a credit score is to show the lender how responsible you are with borrowed funds. Splurging on unnecessary items makes you a riskier borrower, so banks will be less likely to give you credit in the future.

Whether you use your parents’ credit cards or get a separate one (once you meet the necessary conditions), make sure to only use them as a convenience and repay them in full each month or as a last resort. Not only is this a great way to show the credit bureaus and lenders you’re a sensible spender, but you can also avoid excessive interest.

Besides controlling your spending, make sure to always repay the funds timely. You have 29 days from the due date to make the repayment before a late payment is recorded in your credit history. Late payments can stay on your report for up to seven years, damaging your chances of obtaining additional credit.

Source: Mikhail Nilov

Get a Helping Hand From a Parent

Making you an authorized user of their credit card isn’t the only way your parents can support you. Helping you save up for a secured credit card is another option worth considering. With a secured credit card, you must deposit funds as collateral that will also serve as your credit limit.

The main problem with secured credit cards is the cost. Annual fees and interest can be quite high, so expenses can add up.

Traditional credit-building methods like the above are usually inconvenient and flawed in various ways.

If you’re a parent who wants to help their children build a strong credit profile, you can use a simpler and more effective solution—FreeKick.

FreeKick—Credit Building and Credit Profile Protection Made Easy

FreeKick is an innovative approach to helping children aged 13 to 25 build credit. Created by Austin Capital Bank, it combines a Federal Deposit Insurance Corporation-insured (FDIC-insured) deposit account with credit-building services to let parents support their children by:

- Helping them build a strong credit profile

- Monitoring their credit profile to detect signs of identity fraud

You can get started with FreeKick in less than three minutes by doing the following:

- Choose a plan

- Set it and forget it

- Keep growing

Step 1—Choose a Plan and Make an FDIC-Insured Deposit

The last thing parents want is another monthly subscription, so FreeKick offers two plans, one of which is FREE:

| FDIC-Insured Deposit | Annual Fee |

| $3,000 | $0 (Free) |

| No deposit | $149 |

Step 2—Set It and Forget It

FreeKick knows parents are busy, and the last thing they need is another app or account to monitor and manage. As an FDIC-insured bank, as soon as you activate your FreeKick account, Austin Capital Bank automatically builds your child’s credit.

Step 3—Keep Growing

You can renew your FreeKick account every 12 months and keep building your child’s financial future, or close the account and get 100% of your deposit back.

Opening a FreeKick account and boosting your child’s financial future is that fast and simple and you know you can trust FreeKick as a product of an FDIC-insured bank that is audited and examined by state, federal, and independent bank examiners and auditors every year.

Credit Reporting With FreeKick

If your child is a legal adult, FreeKick will immediately start reporting their credit activity to the three major consumer bureaus. In case your child is a minor (typically ages 13 to 17), FreeKick automatically starts building a payment and credit history for them when the account is opened. When they become a legal adult, your child must complete a simple process to activate credit reporting. Once that’s done, their account is reported to the major credit bureaus, and they start their adult life with up to 48 months of credit history, jumpstarting their credit profile and score.

Note that the credit bureaus only accept credit reporting for adults. This means that while you can cancel your FreeKick account at any time without any penalties, no credit can ever be reported for your child’s account if you close it before they become an adult and activate credit reporting.

FreeKick’s Credit Profile Monitoring

FreeKick also includes credit profile monitoring, helping parents safeguard their children’s credit profiles, detect fraudulent activity, and ensure their children’s personal information isn’t misused.

| Services for Minors | Services for Adult Children and Parents |

| Credit profile monitoring Social Security number (SSN) monitoring Dark web monitoring for children’s personal information Up to $1 million identity theft insurance Full-service white-glove concierge credit restoration Sex offender monitoring—based on sponsor parent’s address | Credit profile monitoring SSN monitoring Dark web monitoring for personal information Up to $1 million identity theft insurance Full-service white-glove concierge credit restoration Lost wallet protection Court records monitoring Change of address monitoring Non-credit (Payday) loan monitoring Free FICO® Score monthly FICO® Score factors Experian credit report monthly |

Help your children build a strong credit profile and keep their credit profile protected—sign up for FreeKick.

Featured image source: PabitraKaity