Freekick Deposit Account

Earn up to 5% APY*!

The only savings account that protects your family members’ identities and builds your teens’ credit.

FreeKick is an FDIC-insured deposit account that pays you interest while providing FREE identity protection and credit building for your family

The smart way to protect your family and build their financial future

Services

FreeKick

Other Companies

Free with a deposit of just $1,000

Pay a monthly subscription fee

Save and earn interest

Spend and pay interest

With FreeKick the more you deposit the higher the interest rate you earn.

PROTECT your family’s identity and BUILD their credit.

Open and maintain a minimum balance of $1,000 in your FreeKick FDIC-insured savings account and receive identify protection for your family and credit building for your children.

FreeKick Features and Benefits

Protect your children’s identity and establish a credit profile for teenagers and young adults by savings vs spending.

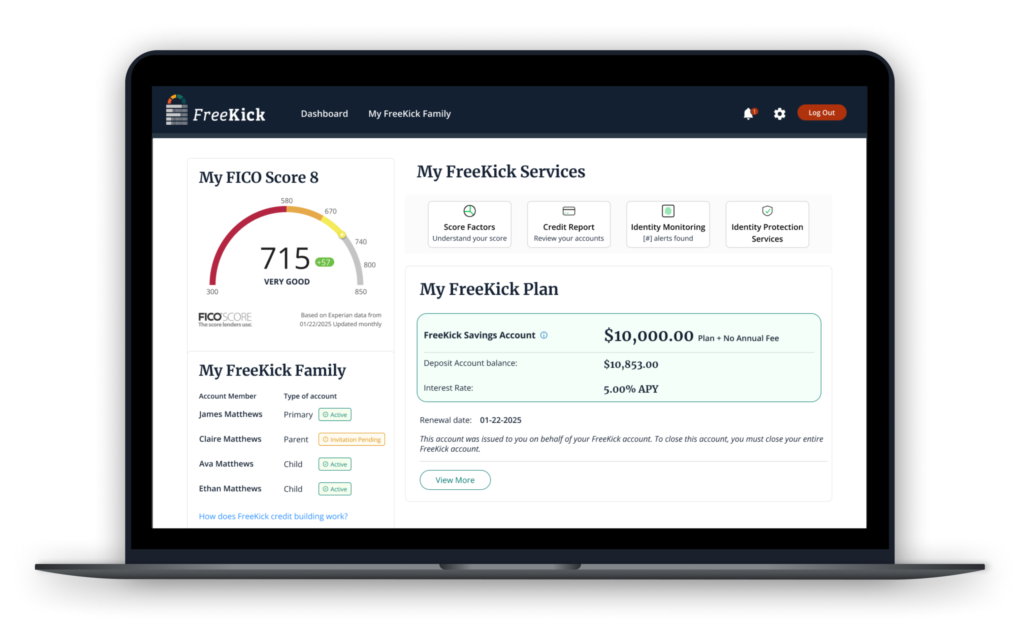

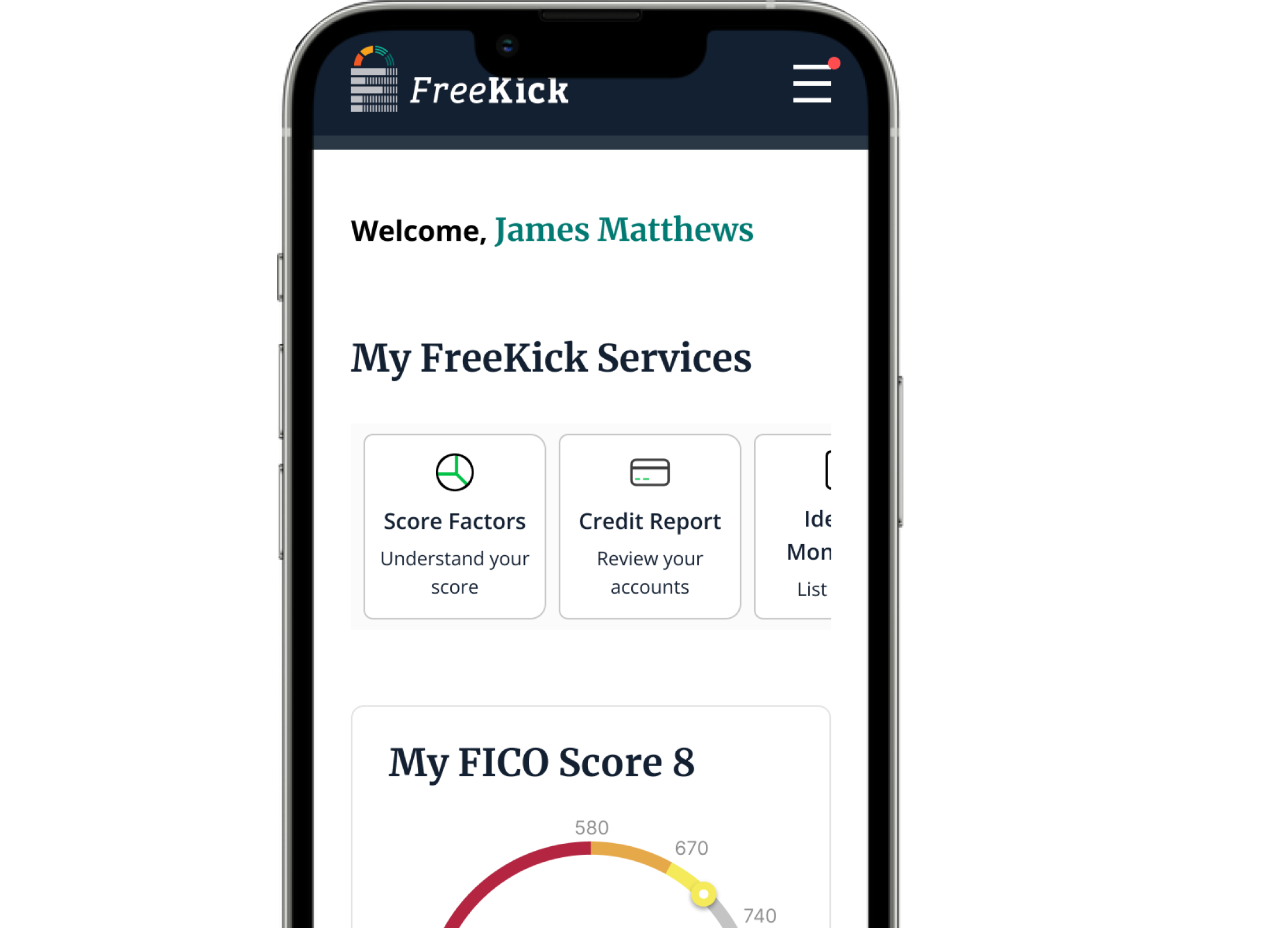

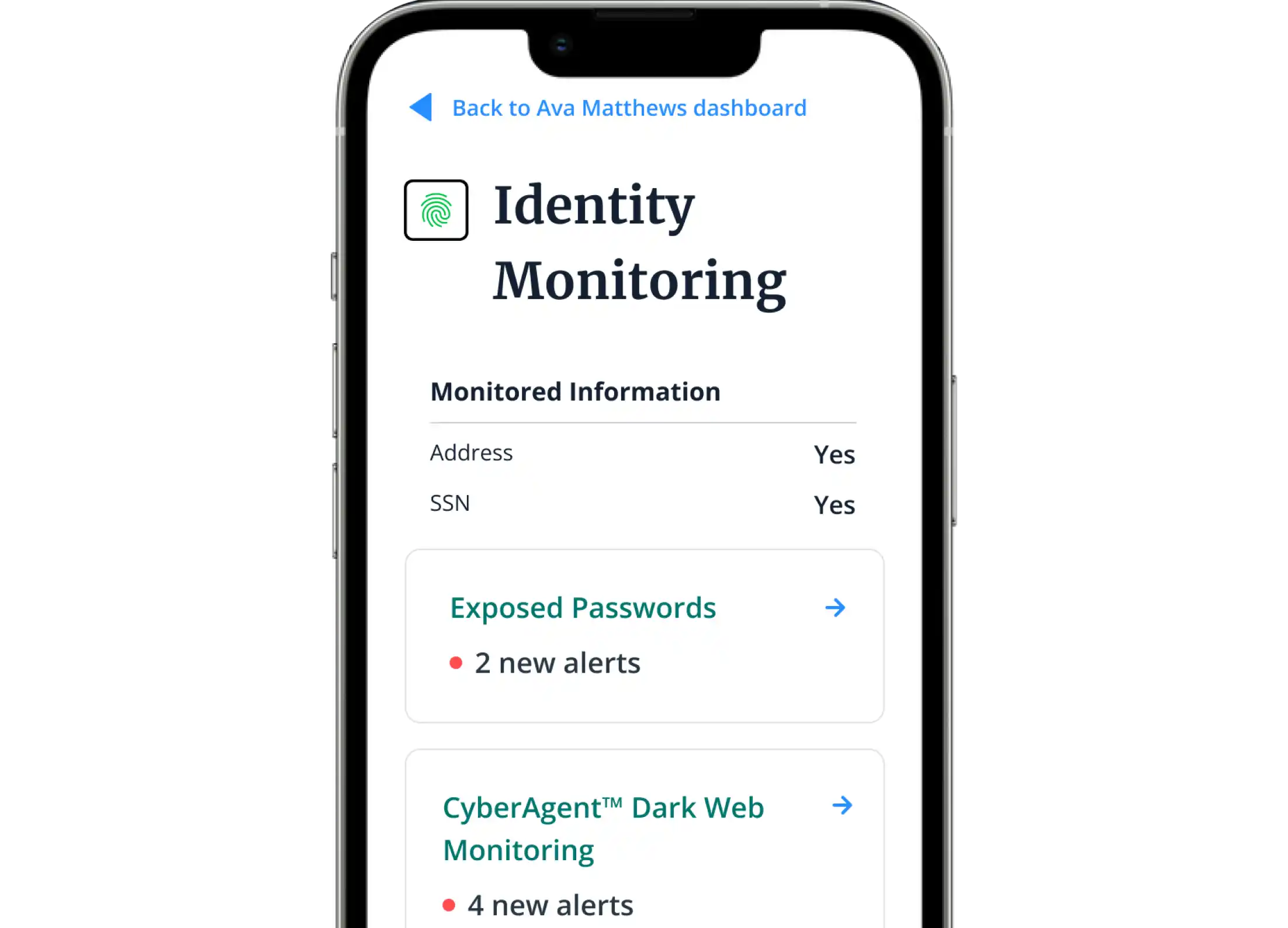

Credit Profile Monitoring

With ongoing credit profile and report monitoring, we keep you abreast of any changes that affect your credit score and profile. By monitoring the factors that influence your credit, you’re able to catch any errors or signs of identity fraud faster. You will also receive access to your credit report.

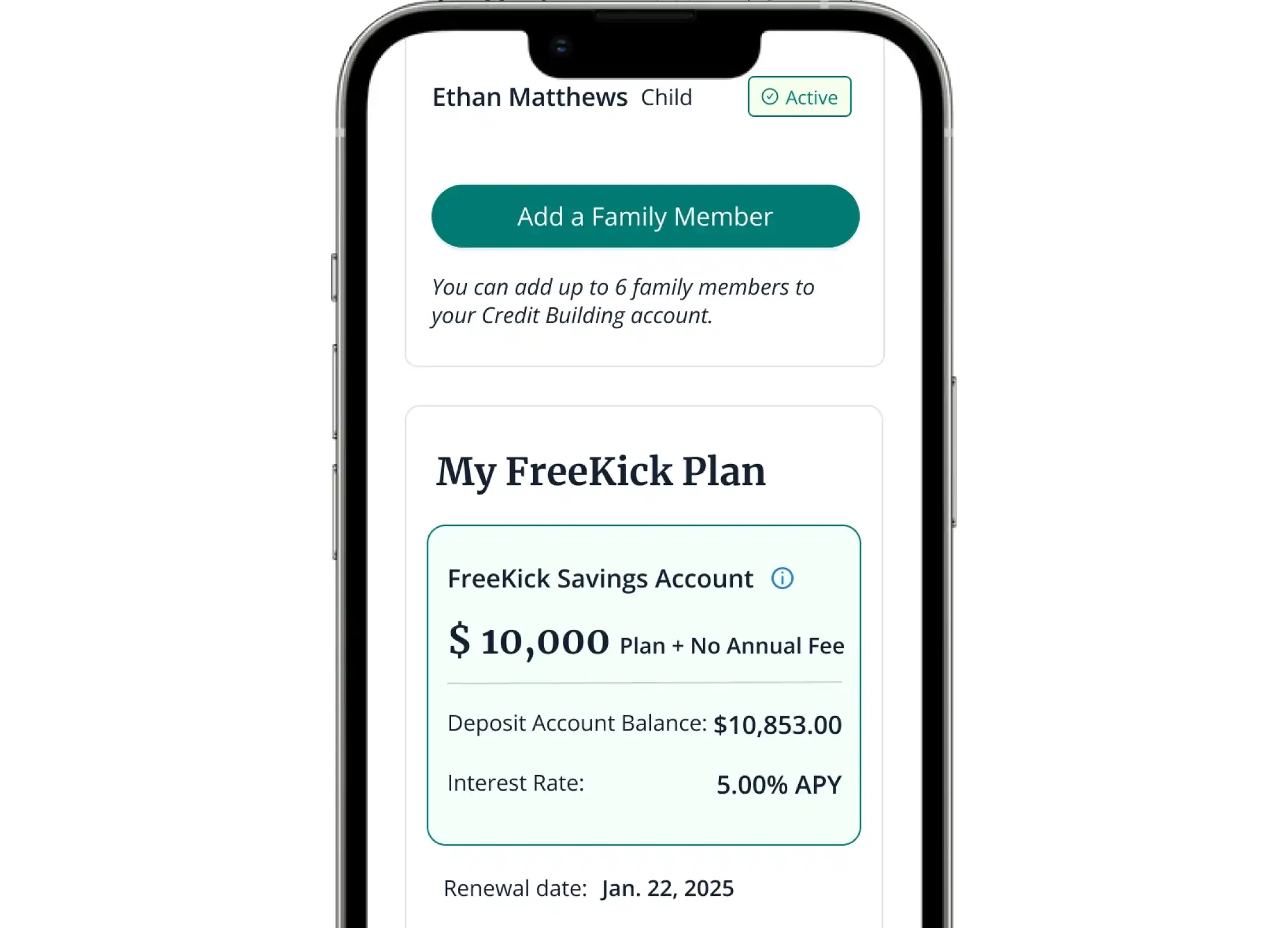

Earn up to 5% APY on your deposit

Make an FDIC-insured deposit from $1,000 up to $10,000 to unlock FreeKick’s free identity protection and credit building features. FreeKick is a division of Austin Capital Bank, Member FDIC. The money in your FreeKick account is insured up to $250,000.

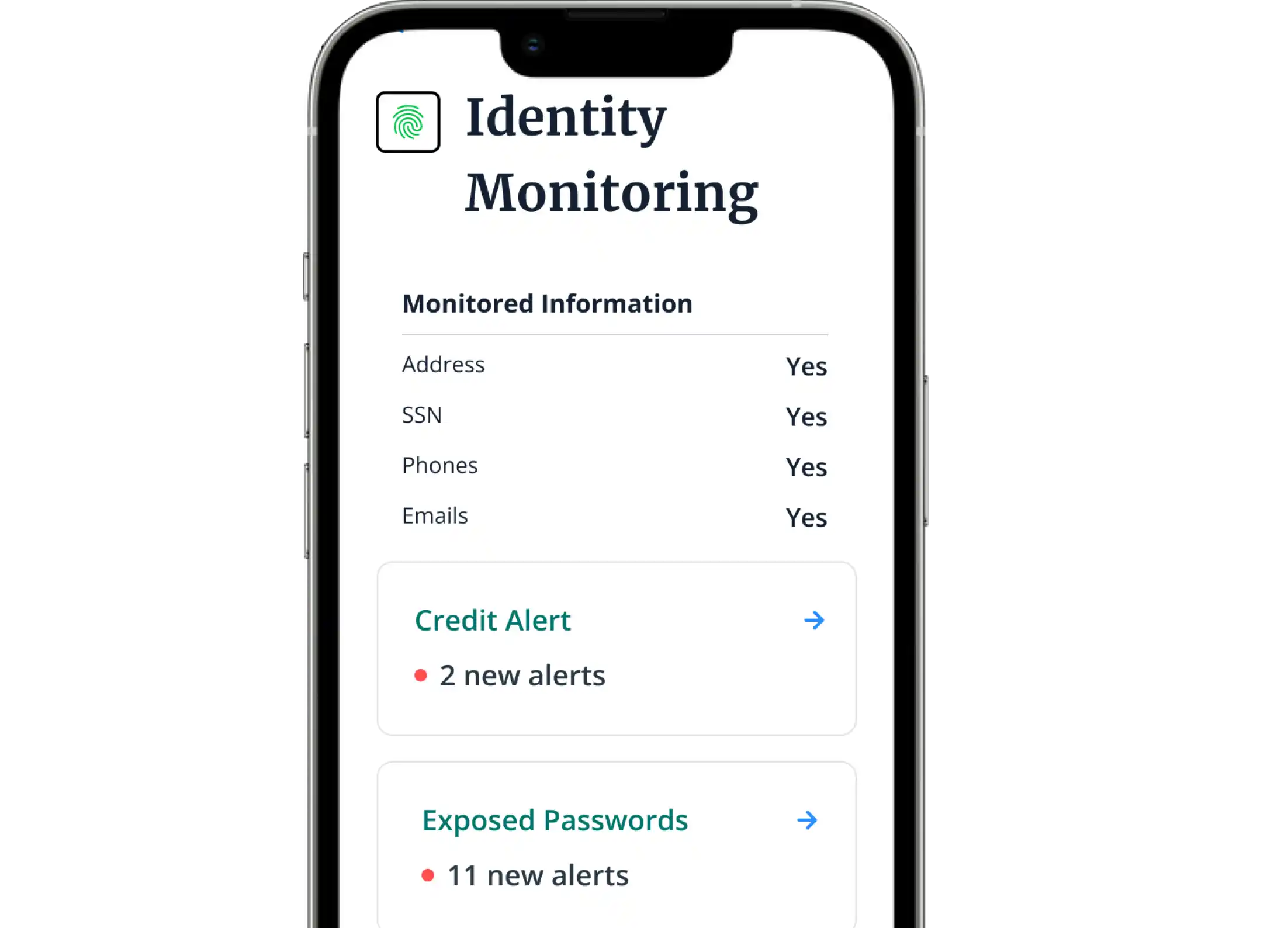

Identity protection for parents

FreeKick provides you with monthly updates to your FICO score, Experian credit report, social security number monitoring, dark web monitoring, lost wallet protection, court monitoring, change of address monitoring, and up to $1 million in identity theft insurance.

Identity protection for your children

One out of four children will be a victim of identity theft before they turn age 18. In fact, every 30 seconds, another child becomes the victim of identity theft. FreeKick monitors the dark web to ensure your children’s credit profile and social security number remain safe while offering up to $1 million in identity theft insurance.

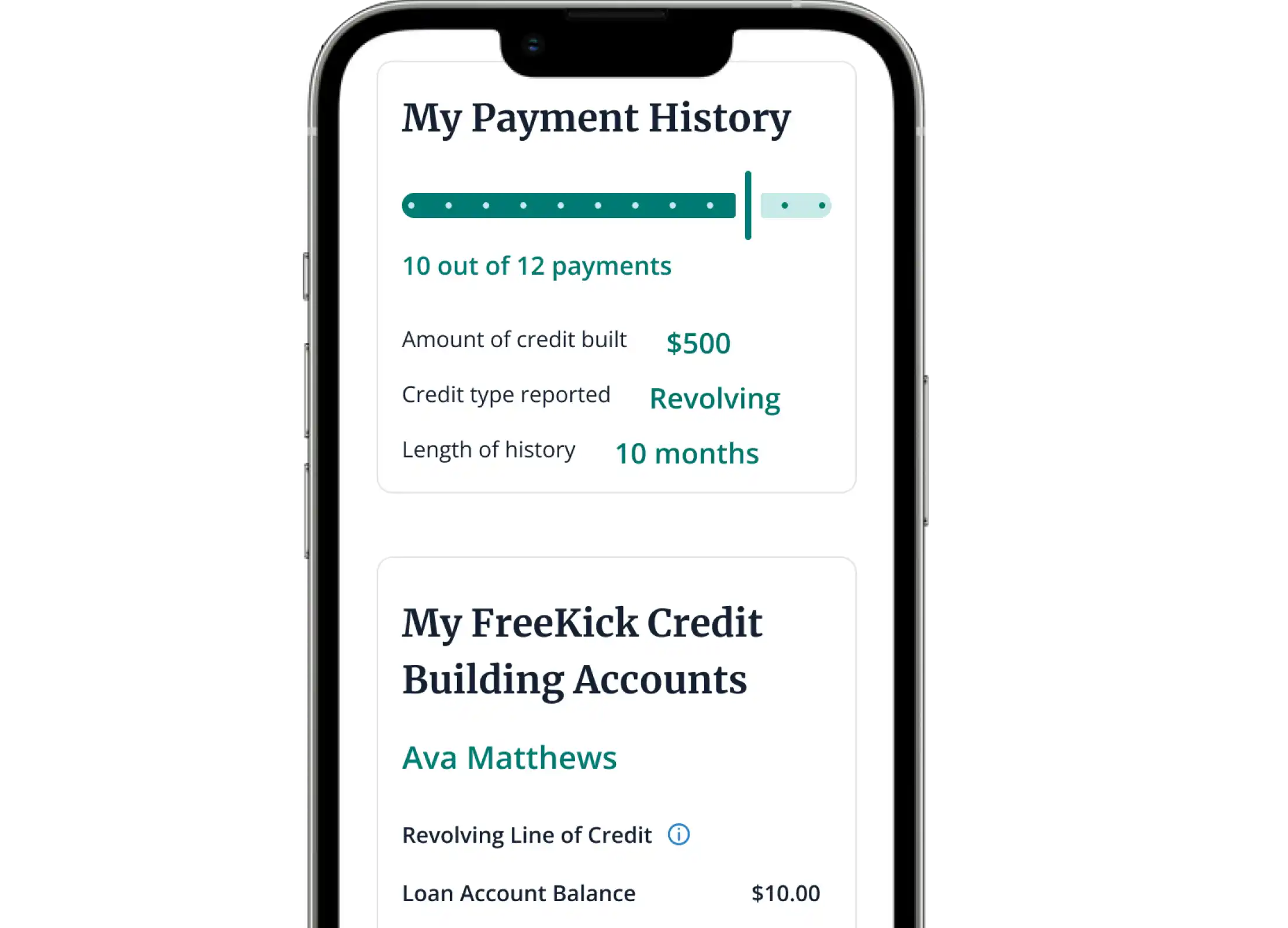

Credit building for your teens

With FreeKick you can start automatically building your children’s credit when they turn 13 using savings instead of spending. We create a primary credit account for your child that can be added to their credit profile when they become an adult, giving them a financial head start as a young adult. Starting adulthood with good credit can save your child more than $200,000 over their lifetime!

Opening a FreeKick account is fast and easy — start protecting your family in minutes.

Security and support backed by an FDIC-insured bank

Protect your money and personal information.

As part of an FDIC-insured bank, we are regularly examined and monitored by the FDIC and state baking regulators for information systems integrity and security. The money in your FreeKick account is insured up to $250,000 while earning up to 5% APY.

If it’s not FreeKick.BANK, it’s not us.

Only a US-based bank can obtain a .BANK domain, making it difficult to spoof our website or use email phishing to obtain your information. Lookalike domains are used in over 90% of all cyberattacks.

Learn more about identity protection and credit building.

Want to learn more?

Speak with a live US-based customer support and product specialist during business hours or leave us a message after hours.

Business hours:

Monday – Friday: 8am – 5pm Central Time

Phone Support :

Secure Chat Support

Click ‘Chat Support’ on computers or on mobile devices in the lower right-hand corner of your screen.