A Detailed Child Identity Theft Description and Protection Guide

Start Building Your

Child’s Credit

Few crimes are as elaborate and hard to resolve as child identity theft. Millions of children have been affected in only the last few years, and many theft cases have left long-term consequences on the victims and their families.

Protecting your child’s identity requires a multifaceted approach, and the first step is to familiarize yourself with the nature of ID theft and its key parts. To help, this guide offers a detailed child identity theft description with examples so you know what to look out for and outlines the key information you should know. We’ll go over the following FAQs:

- What is child identity theft?

- Why do criminals target children’s information, and how do they obtain it?

- How do you know if your child has fallen victim to theft?

- How can you safeguard your child’s sensitive information?

The Definition of Child Identity Theft

Child identity theft is a complex crime where the perpetrator obtains a minor’s personally identifiable information (PII) and uses it for malicious or fraudulent purposes. It’s often financially motivated and results in illegal loans or purchases made in the child’s name.

Still, the uses of a child’s identity go beyond financial gain. The thief can evade the law and hide their own identity behind it when they’re:

- Seeking employment using the child’s information

- Renting an apartment under their name

- Signing up for various services and applying for government benefits

How Does Child Identity Theft Occur?

In most cases, child identity theft involves a minor’s Social Security Number (SSN). If someone steals it, they can commit fraud in two ways:

- Impersonating the child

- Creating a synthetic identity

Once a criminal gets ahold of a child’s SSN, they combine it with fake information to create a new identity under which they commit fraud.

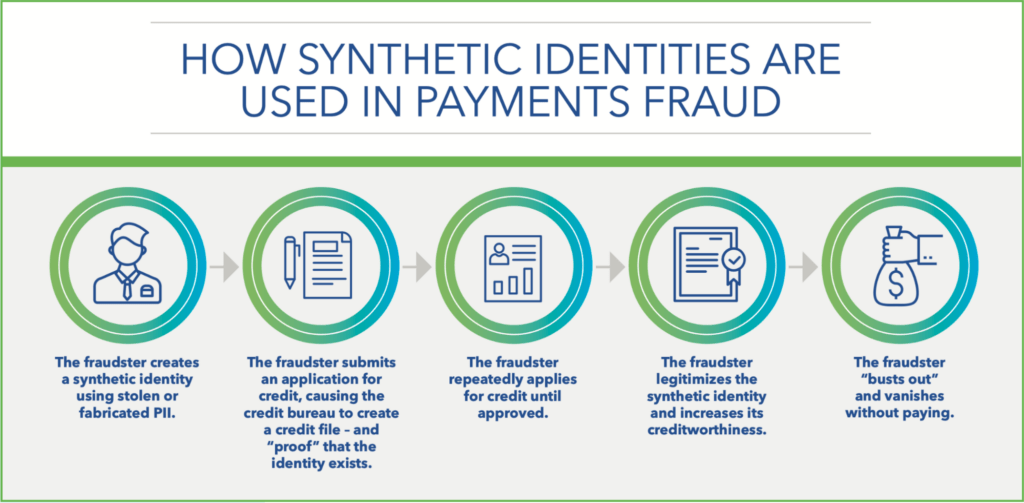

In many cases, the fraudster targets banks and other financial institutions to obtain illegal loans. The following diagram from the Federal Reserve’s whitepaper on synthetic identity fraud describes this crime in more detail:

Source: The Federal Reserve: Detecting Synthetic Identity Fraud in the U.S. Payment System

Synthetic identity fraud can go unnoticed for years. To understand how this is possible, you should know what makes children’s information so desirable to criminals.

Why Children Are Targets of Identity Theft

Children are up to 51 times more likely to have their identities stolen than adults, and there are three main reasons for this:

- Their IDs aren’t monitored as closely as those of adults

- SSNs of children born after mid-2011 are randomized, which makes them harder to connect to the legitimate owner

- Children are typically unaware of the dangers of giving their personal information to strangers

Combine the above with the fact that children are far less likely to spot identity theft than adults, and you can see why many cases remain unresolved for years. As a parent, it’s your job to stay on the lookout for red flags and react swiftly if you notice any misuse of your child’s PII.

Child Identity Theft—Examples and Warning Signs

Besides dark web criminals’ tendency to steal minors’ identities for credit application purposes, this crime can take numerous forms. Your child might be ineligible for different services, loans, or benefits as a result of someone having already obtained them.

This is precisely what happened to a 16-year-old boy who couldn’t get a driver’s license because someone had stolen his identity and gotten it instead. The worst part is—the thief was his father. Familial ID theft is disturbingly prevalent, but it’s not uncommon for a victim to not know the perpetrator.

In any case, the most common signs that your child’s PII may have been stolen include the following:

| Sign | What It Could Mean |

| The child has a credit profile without a legitimate credit history | The credit bureau created a credit profile connected to the child’s SSN upon a loan request made by the perpetrator |

| Correspondence from the IRS addressing the child | The criminal committed tax fraud, most likely to claim returns |

| The child received a pre-approved credit card offer | The perpetrator applied for a credit card in the child’s name |

If you notice any of these red flags, you must take immediate action to prevent further damage to your child’s identity and financial future.

What To Do if a Child’s Identity Is Stolen

Identity theft remediation can be a complicated and time-consuming endeavor. While each case is different, the universal steps you should take are as follows:

- Report the theft to all relevant authorities

- Contact credit bureaus

- Reach out to the affected lenders

How To Report Child Identity Theft

Depending on the specifics and consequences of ID theft, there are several authorities you can turn to for help. In most cases, you should contact local law enforcement because you might need an official police report.

Then, you can reach out to the Federal Trade Commission (FTC) and seek help. There’s a dedicated government-backed ID theft platform you can use to submit a report. The FTC will devise a resolution strategy and can guide you through the process.

If the fraud involves your child’s SSN, make sure to also notify the Social Security Administration (SSA). You can contact the Office of the Inspector General (OIG) through the website or by calling 1-800-269-0271.

The OIG will assess your case and suggest corrective action. In rare cases, the SSA might let you change the child’s SSN. This option is available if you can prove that the child is suffering ongoing damage as a result of the SSN theft and you’ve exhausted other options.

Reach Out to the Three Major Consumer Credit Bureaus

Credit fraud can put many roadblocks on your child’s journey to financial stability. If someone obtains illegal loans in their name, all debt and related issues will likely show up on the child’s credit profile.

To clean up the child’s credit profile and prevent additional damage, you need to contact the three major credit bureaus:

Once you’ve gathered evidence of identity fraud, you can dispute the illegal activity and request its removal from the child’s credit profile. You might also want to freeze the credit profile, which would make it inaccessible to new lenders so that the thief can’t obtain new loans.

Note that a credit freeze must be placed with all credit bureaus separately, which can be time-consuming and inconvenient. A fraud alert is a simpler alternative, though it doesn’t offer as much protection—it only encourages lenders to take extra steps to verify a credit applicant’s identity.

Contact the Affected Lenders

Your child’s credit report should show all loans obtained in their name, so you can file complaints and fraud reports with all the scammed lenders. Contact their fraud departments and provide all the proof you’ve collected.

Note that doing so won’t necessarily lead to debt forgiveness. Your child might still be held accountable for the outstanding balance, which means you could still pay for them. Still, reporting fraud is important to ensure your child doesn’t get caught up in legal issues tied to the loan.

How To Prepare Against Child Identity Theft

Dealing with child identity theft involves numerous parties and processes. Luckily, you can save yourself all that trouble by being proactive and following a few ID security practices:

- Teach your child to keep their information safe

- Stay on top of their social media activity

- Be careful with document disposal

- Sign your child up for identity monitoring

Educate Your Child on Identity Protection

While you may know how to safeguard your child’s documents and PII, this may not be true for them—especially if they’re still young. Children are often highly impressionable, so a fraudster might not have trouble extracting their SSN and other details from them.

To counter this issue, teach your child not to reveal their sensitive information to strangers or even people they know. ID fraud is often committed by someone known to the victim, so the child should be wary of any request for their details no matter how much they trust the person.

It’s also best to take over filling out any forms until your child is mature and responsible enough to do it. Note that while only a handful of institutions need your child’s SSN, many of them include the related field in their forms as a part of standard practice.

In many cases, you can leave the field blank. If someone truly needs the number, they’ll reach out and ask for it. You can then determine whether the SSN is necessary or another identifier can be used instead.

Monitor Your Child’s Social Media Activity

According to Javelin’s report, social media use significantly increases the risk of identity theft. The following excerpt elaborates on this finding:

“Javelin finds a direct correlation between children’s use of social media and the increase in the number of children who are being exposed online. In fact, Javelin found that children under the age of 7 were most likely to be victimized by ID theft and subsequent ID fraud.”

The same report shows that around 70% of parents don’t monitor their children’s social media activity, which further enables this problem.

While you should certainly respect your child’s privacy, knowing where they spend time online is as important as where they go offline. Numerous online attacks are tailored to unassuming children, so review your child’s activity and teach them to exercise caution when communicating with new people.

Dispose of Sensitive Documents Carefully

Throwing away important documents can be dangerous because you might leave various identifiers unprotected. Dumpster diving that results in identity theft isn’t as rare as you might think, so don’t leave anything to chance.

To avoid this, shred all documents you plan on throwing away. If this isn’t an option, do what you can to conceal or remove sensitive information before disposal.

Consider Paid Identity Monitoring

Parents are typically swamped with responsibilities, so watching over their child’s identity on top of everything else might seem too stressful. Doing so on your own means you’d have to be on a constant lookout for danger, which can be quite anxiety-inducing.

To help you safeguard your child’s PII and enjoy peace of mind without sizable expenses, Austin Capital Bank offers a budget-friendly solution—FreeKick (Coming Soon).

Paying a monthly subscription or a high annual fee for identity protection is expensive and can add up to thousands of dollars. With FreeKick, you can keep the money you save for your children and protect them at the same time.

Save over $10,000 during your children’s childhood with family identity protection from FreeKick—let’s take a closer look:

| Cost Details | FreeKick1 | FreeKick1 | LifeLock2 |

| FDIC-insured deposit | $3,000 | $0 | $0 |

| Cost per year | $0 | $149 | $600 |

| Annual savings | $600 | $451 | |

| Savings over 18 years | $10,800 | $8,118 |

1 FreeKick plans cover two parents and up to six children. The table shows two different plans

2 LifeLock Advantage Family plan for two parents and up to five children. The annual plan is $599.99, and the monthly plan is $59.99/mo, $719.88 for 12 months

Use FreeKick To Safeguard Your Family’s Identities

Identity theft is so widespread that a child’s identity is stolen every 30 seconds, making identity protection services invaluable. That’s where FreeKick by Austin Capital Bank comes in—this two-in-one platform protects your child’s identity and builds credit for them.

How FreeKick’s Protects Your Family’s Identities

FreeKick offers identity protection services for minors, adult children, and parents, making it a comprehensive identity protection package for your whole family. For minors, FreeKick offers the following services:

- Credit profile monitoring

- Social Security number (SSN) monitoring

- Dark web monitoring for children’s personal information

- Up to $1 million identity theft insurance

- Full-service white-glove concierge credit restoration

- Sex offender monitoring—based on sponsor parent’s address

For adult children and parents, FreeKick offers:

- Credit profile monitoring

- SSN monitoring

- Dark web monitoring for personal information

- Up to $1 million identity theft insurance

- Full-service white-glove concierge credit restoration

- Lost wallet protection

- Court records monitoring

- Change of address monitoring

- Non-credit (Payday) loan monitoring

- Free FICO® Score monthly

- FICO® Score factors

- Experian credit report monthly

How FreeKick Builds Credit

FreeKick builds credit for children aged 13 to 25 in three simple steps:

- Create an Account—Sign up on FreeKick.bank and choose a deposit that suits your budget

- Set It and Forget It—FreeKick will start building 12 months’ worth of credit history for your child

- Keep Growing—After 12 months, close the account without any fees (or continue building credit for your child for another year)

These steps give your child the opportunity to have five years’ worth of credit history when they turn 18. This will help them save $200,000 during their lifetimes by giving them access to better loan terms and other financial benefits.

FreeKick Pricing

FreeKick offers two pricing plans:

| FDIC-Insured Deposit | Annual Fee |

| $3,000 | $0 (Free) |

| No deposit | $149 |

Both plans offer:

- Credit building for six children aged 13 to 25

- Identity protection for two parents and six children aged 0 to 25

Secure your family’s identity and financial future—sign up for FreeKick today.