How To Get My Kid’s Social Security Number—Application Process Explained

Start Building Your

Child’s Credit

A Social Security number (SSN) serves many purposes, especially during adulthood. If your child still doesn’t have one, you may wonder, “how to get my kid’s Social Security number?”

Applying for a child’s SSN is relatively straightforward, though there are a few important considerations to keep in mind. This article will share all you need to know and answer some of the most important questions, including:

- Is an SSN obligatory for children?

- When and how to get your kid’s Social Security number

- How to find your kid’s Social Security number if their card is lost

- How to protect the child’s SSN (and why it’s necessary to do so)

Is It Necessary To Obtain a Social Security Number for a Child?

You’re not obligated to get an SSN for your child, but doing so while they’re still young is a good idea for various reasons. Your child will need it if you want to do any of the following:

- Claim them as a dependent on tax returns

- Open bank accounts for them

- Obtain government benefits and medical coverage for the child

An SSN is used to track the holder’s income, credit, and numerous other information, so your child will need it anyway once they grow up and become independent. While they can apply for it on their own when they grow up, it’s better to get this process out of the way as soon as possible.

When Does a Child Get a Social Security Number?

Your child can get an SSN soon after they’re born if you decide to apply at the hospital. This is done through the application for their birth certificate, which will ask if you’d like to get the SSN immediately.

If so, the process works as follows:

- You and your spouse provide your SSNs in the application (if possible)

- The state agency in charge of issuing birth certificates shares the information with the Social Security Administration (SSA)

- The SSA assigns the SSN and mails you the child’s Social Security card

If you choose not to get your child’s SSN at birth, you can do it later by contacting the SSA.

How To Get a Social Security Number for a Minor From the SSA

There are two ways to apply for an SSN in your child’s name:

- Submitting an online request

- Filling out and mailing the request in paper form

Online application is quite straightforward—all you have to do is visit the SSA’s portal, which will guide you through all the necessary steps. Note that you’ll also need to visit your local SSA office after submitting the request because the application must be completed in person.

Keep in mind that children who are 12 or older must visit the SSA’s office for an interview even though you’re obtaining the SSN in their name. While you can sign everything for the child, you can’t get an SSN without them present.

If you can’t access the online application page, you can fill out the SS-5 form and mail it alongside the necessary documentation to your local SSA office. The form contains all the relevant information, so make sure to read through the instructions before completing it.

The Documents Required for a Minor’s SSN

The most important documentation you’ll need when applying for an SSN in your child’s name is proof of their identity, age, and U.S. citizenship. You must submit at least two separate documents, which can include the following:

- Birth certificate or passport

- State-issued nondriver ID card

- Adoption decree (for foster children)

- Religious or certified medical records

You’ll also need to prove your own identity by submitting any of the following documents:

- Driver’s license or state-issued non-driver ID card

- Passport

- Health insurance card

- Certificate of U.S. citizenship

Note that the documentation can vary depending on your circumstances. You can contact the SSA by emailing them or calling 1-800-772-1213 to inquire about the specifics. Regardless of whatever you’re sending, all documents must be originals or certified copies.

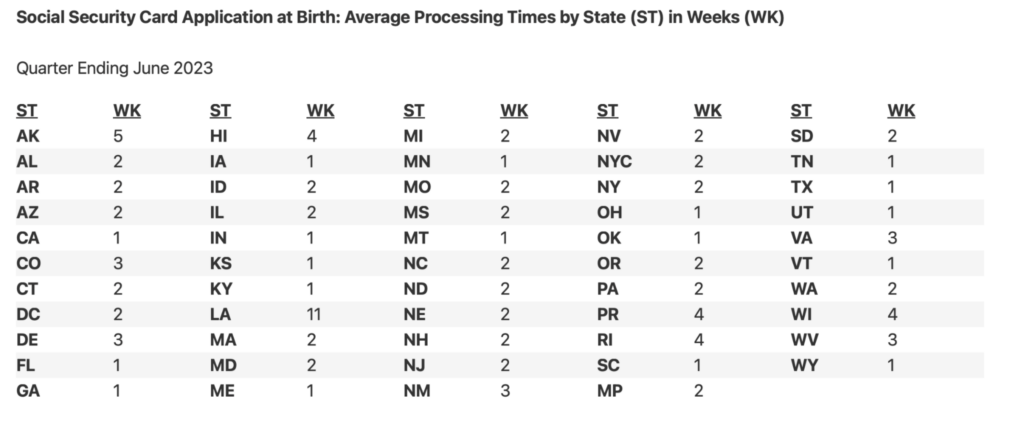

How Long Does It Take To Receive Your Child’s SSN?

Once the SSA has reviewed your application and verified all of the documents, you should receive the child’s Social Security card and number within 14 days. Still, processing times can vary significantly between states—you can find more details below:

Source: Social Security Administration FAQs

After receiving your child’s Social Security card, you can refer to it whenever you need the child’s SSN for the aforementioned purposes.

How To Find a Social Security Number for a Child if the Card Is Lost

Losing your child’s Social Security card is quite inconvenient, especially if you haven’t memorized the SSN. You may find it on previous tax returns if you’ve claimed your child as a dependent since the IRS requires it for filing.

The good news—you can reach out to the SSA and request a replacement card. You get a maximum of three replacements per year and ten per lifetime, so keep this limit in mind.

Note that a replacement card doesn’t change the child’s number. Doing so is only allowed in a few instances, such as abuse or ongoing harm due to identity theft.

The latter scenario is disturbingly prevalent, as children’s SSNs are tempting to identity criminals who use them to either impersonate the child or combine their SSN with fake information to create a synthetic identity. That’s why it’s crucial to ensure adequate protection of your child’s Social Security card and number.

How To Safeguard Your Child’s SSN

An SSN only needs to be revealed in a handful of scenarios, so it’s best to store your child’s Social Security card at home and avoid carrying it with you. Both the card’s location and the number itself should be shared on a need-to-know basis, and it might be best to keep them a secret from your child until they’re mature and responsible enough to safeguard this information.

This is because identity criminals intentionally target children due to their lack of skepticism when it comes to sharing sensitive information. To reduce the risk of this happening to your child, teach them about the importance of ID security before entrusting them with their SSN.

You should also closely monitor your child’s SSN and other identifiers because child identity theft often goes unnoticed until a lot of damage has been done. The problem is—extensive monitoring requires tools unavailable to the general public and can be time-consuming.

If you need a helping hand, Austin Capital Bank offers a solution worth considering—FreeKick. FreeKick launches your children into adulthood with the dual advantages of strong credit and a clean protected identity.

Use FreeKick To Safeguard Your Family’s Identities

Identity theft is so widespread that a child’s identity is stolen every 30 seconds, making identity protection services invaluable. That’s where FreeKick by Austin Capital Bank comes in—this two-in-one platform protects your child’s identity and builds credit for them.

How FreeKick’s Protects Your Family’s Identities

FreeKick offers identity protection services for minors, adult children, and parents, making it a comprehensive identity protection package for your whole family. For minors, FreeKick offers the following services:

- Credit profile monitoring

- Social Security number (SSN) monitoring

- Dark web monitoring for children’s personal information

- Up to $1 million identity theft insurance

- Full-service white-glove concierge credit restoration

- Sex offender monitoring—based on sponsor parent’s address

For adult children and parents, FreeKick offers:

- Credit profile monitoring

- SSN monitoring

- Dark web monitoring for personal information

- Up to $1 million identity theft insurance

- Full-service white-glove concierge credit restoration

- Lost wallet protection

- Court records monitoring

- Change of address monitoring

- Non-credit (Payday) loan monitoring

- Free FICO® Score monthly

- FICO® Score factors

- Experian credit report monthly

How FreeKick Builds Credit

FreeKick builds credit for children aged 13 to 25 in three simple steps:

- Create an Account—Sign up on FreeKick.bank and choose a deposit that suits your budget

- Set It and Forget It—FreeKick will start building 12 months’ worth of credit history for your child

- Keep Growing—After 12 months, close the account without any fees (or continue building credit for your child for another year)

These steps give your child the opportunity to have five years’ worth of credit history when they turn 18. This will help them save $200,000 during their lifetimes by giving them access to better loan terms and other financial benefits.

FreeKick Pricing

FreeKick offers two pricing plans:

| FDIC-Insured Deposit | Annual Fee |

| $3,000 | $0 (Free) |

| No deposit | $149 |

Both plans offer:

- Credit building for six children aged 13 to 25

- Identity protection for two parents and six children aged 0 to 25

Secure your family’s identity and financial future—sign up for FreeKick today.