All You Need To Know About Restricted Bank Accounts for Minors

Start Building Your

Child’s Credit

Everything you do as a parent is an investment in your child’s future. You should give your child every possible advantage while they’re young so that their adulthood starts off without struggles.

Setting up a restricted guardianship account is a smart step toward this goal. There are several reasons to open one, and we’ll explore them in this guide. We’ll also cover the process and key considerations of opening a restricted bank account for a minor, so you’ll have all the necessary information to decide whether you should open one for your child.

What Are Restricted Bank Accounts for Minors?

A restricted account for a minor makes funds inaccessible to a child. It must be set up by a parent or legal guardian, who may access the funds under specific circumstances, which we’ll discuss later in this guide.

There are two main reasons to open a restricted account:

- The court requested one to place funds from legal proceedings

- You want to save for your child’s future without the risk of anyone spending the money

How Does a Court Bank Account for Minors Work?

Source: EKATERINA BOLOVTSOVA

If your child was a victim of a crime, and the resolution involves a financial payout, the court will place the received funds in a restricted account to ensure that:

- The child can’t use the funds until they’re ready to make sensible financial decisions

- The guardian can’t exploit the funds and use them for any purpose that isn’t aligned with the child’s well-being

The guardian—also known as the conservator—can only access the funds if the court allows it. You’d have to submit a petition for withdrawal, the rules of which may vary between states. For example, Arizona requires a minor’s consent for the withdrawal if they’re over 14 years old, even though the child isn’t allowed to access or manage the funds themselves.

Regardless of the state of residence, you’ll need to prove that the withdrawn funds will go toward something benefiting your child that you can’t afford otherwise. You’ll likely need to attend a hearing where you’ll explain the reason for the withdrawal to a judge, who’ll rule on the petition’s outcome.

You can set up a court-ordered guardianship account with any bank, so contact your financial institution to inquire about the steps.

Opening a Restricted Savings Account

A savings account is a wise financial decision that can make your child’s important milestones much easier. Helping your child pay for college, buy a home, and move abroad are some of the main endeavors for which you should start saving early.

Whatever your goals are, a custodial account is an excellent option. It’s more restricted than a typical joint savings account as only the custodian can manage the funds until the child comes of age.

Besides saving money, a custodial account can also be used for investment. It can hold various assets like stocks and bonds, so you can help your child build significant wealth by the time they’re ready to take over the account.

When this happens, your child will get unrestricted access to all the account’s assets. That’s why opening a custodial account is an important matter you should consider carefully.

How To Set Up a Restricted Bank Account for a Minor

If the court orders a restricted bank account, they’ll outline the steps you must follow. You don’t have much influence over the process as it must happen in accordance with state and/or federal law.

This isn’t the case with custodial accounts, which are quite straightforward. All you need to do is reach out to your chosen financial institution (e.g., a bank or credit union), provide basic personal information, and choose the beneficiary.

Simple as the process may be, everything preceding it might require time and careful thinking. Before you open a custodial account, you should consider:

- The account type

- Benefits and drawbacks

Comparing Custodial Account Types

There are two types of custodial accounts you can open:

- Uniform Gifts to Minors Act (UGMA)

- Uniform Transfers to Minors Act (UTMA)

Both account types are named after the legislation that governs them. While they serve the same general purpose, there are significant differences you should keep in mind.

UTMA accounts offer a broader range of assets you can hold. Besides typical financial assets, they can also include intellectual property, art, and other less common assets unsupported by UGMA.

The minimum age for inheriting assets is higher with UTMA accounts and varies between states. Most states require the child to be at least 21 to take over the account, which can be a double-edged sword. It’s a useful restriction if you’re concerned about your child’s financial management skills, but it also means they won’t be able to develop those skills through practice until later in life.

Your chosen account will depend on your financial situation and assets. If you only want to store money, a UGMA account might be a better option as your child will get access to the funds sooner. If you’re serious about investing and want to create a diverse portfolio of assets, a UTMA account might make more sense.

Pros and Cons of Custodial Accounts

Besides ensuring your child can’t access the funds or assets until you’ve had time to help them build healthy spending habits, custodial accounts offer several significant benefits:

- Flexibility—Custodial accounts don’t impose income or contribution limits, and you’re not obligated to make regular contributions

- Easy and affordable setup—Most financial institutions let you set up custodial accounts quickly, and there are typically no administrative costs

- Versatility—Custodial accounts don’t limit you to cash contributions—you can invest in a variety of assets

Despite these advantages, a custodial account might not be for everyone. They don’t offer as many tax benefits as a custodial Individual Retirement Fund (IRA) or a college savings plan like 529 accounts.

Custodial accounts also hold valuable assets, so your child may be ineligible for financial aid later in life. You should be certain your child can fund their significant purchases from the account to avoid doing them more harm than good.

Want To Support Your Child’s Future? Help Them Build Credit

Saving money for your child isn’t the only way to help them secure a financially stable future. There’s a high chance they’ll need a loan at least once in their life, so you need to make sure they can obtain credit when needed.

Helping your child build a strong credit profile early on is an excellent way to establish their reliability as a borrower. Every creditor will look at their credit score before lending them money, so you should help them maximize it.

Many parents try doing this by adding children to their credit cards because the CARD Act of 2009 made it exceptionally hard for minors and young adults to obtain their own. The problem with this approach is that your child doesn’t build independent credit but piggybacks on yours. When you remove the child from the card, all associated credit history gets erased from their profile.

If you need a more reliable and convenient way to set your child up for a stable financial future, FreeKick can help.

FreeKick—Simple Credit Building for Children and Young Adults

Powered by Austin Capital Bank, FreeKick combines a Federal Deposit Insurance Corporation-insured (FDIC-insured) deposit account with additional services to help you build your child’s credit profile.

Investing in your children’s future can be expensive, so FreeKick doesn’t want to burden parents with another monthly subscription. You can use the service for FREE with a one-time deposit of $3,000 or choose another plan with no deposit and a low annual fee:

| FDIC-Insured Deposit | Annual Fee |

| $3,000 | $0 (Free) |

| No deposit | $149 |

You can get started without tedious trips to the bank—here’s what the process entails:

- Create an Account—Go to FreeKick.bank, sign up for an account, and choose a deposit that suits your budget

- Set It and Forget It—FreeKick will start building 12 months’ worth of credit history for your child

- Keep Growing—After 12 months, you can either close the account without any fees or choose to continue building credit for your child for another year

Once the account is active, FreeKick will start building your child’s credit history and report it to the three nationwide consumer credit bureaus if they’re of legal age (18 in most states). Minors can also build a credit history, but it will be reported when they reach the age of majority, as credit bureaus only accept it for adults. Either way, your child will start a credit profile without any action needed on your part.

FreeKick doesn’t penalize early cancellations, so you can cancel the subscription at any time. Keep in mind that if you cancel it before your child becomes a legal adult and activates credit reporting, no reporting can be done for the account.

The Importance of Credit Profile Monitoring for Minors and Young Adults

Identity fraud is a rising concern in the U.S., and minors are particularly vulnerable to it. Having randomized Social Security numbers (SSNs) as of 2011 and not having a credit history that can be associated with their SSNs makes them more prone to fall victim to fraudulent activities.

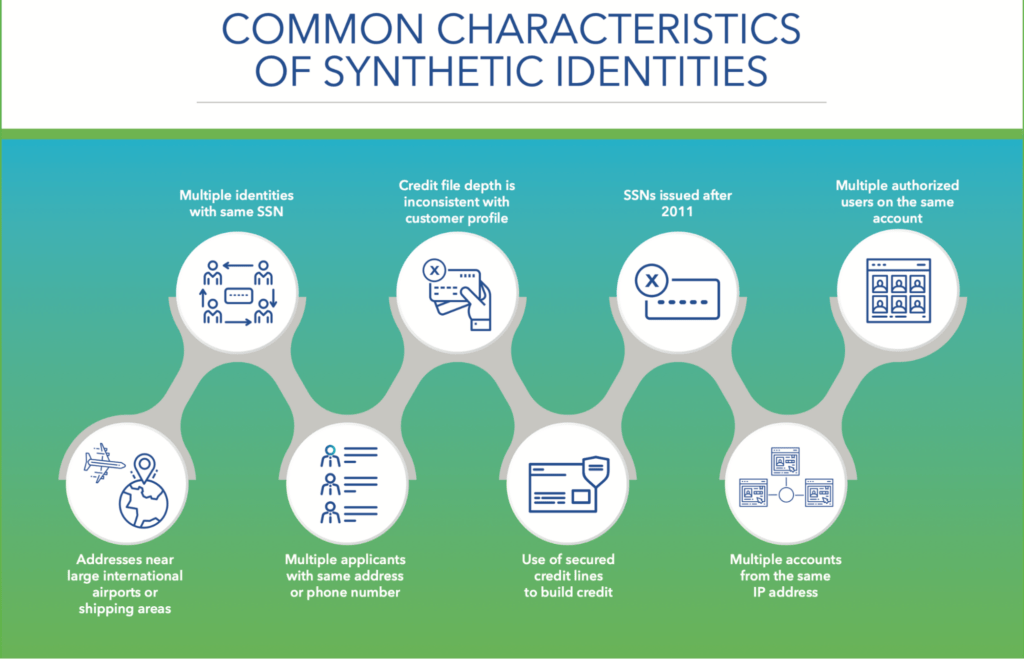

Despite their best efforts, parents might struggle to detect signs of identity fraud before damage is done. The following image from the Federal Reserve’s whitepaper on synthetic identity fraud outlines some of the most common red flags:

Source: The Federal Reserve: Detecting Synthetic Identity Theft in the U.S. Payment System

Most parents don’t have the necessary tools to spot the above signs, so FreeKick offers credit profile monitoring to proactively reduce the chances of identity fraud.

| Services for Minors | Services for Adult Children and Parents |

| Credit profile monitoring Social Security number (SSN) monitoring Dark web monitoring for children’s personal information Up to $1 million identity theft insurance Full-service white-glove concierge credit restoration Sex offender monitoring—based on sponsor parent’s address | Credit profile monitoring SSN monitoring Dark web monitoring for personal information Up to $1 million identity theft insurance Full-service white-glove concierge credit restoration Lost wallet protection Court records monitoring Change of address monitoring Non-credit (Payday) loan monitoring Free FICO® Score monthly FICO® Score factors Experian credit report monthly |

To mitigate the risk of identity fraud while helping your child build a strong credit profile, sign up for FreeKick.

Featured image source: Andrea Piacquadio