Start Building Your Child’s Credit

Credit card theft is a serious offense that can result in various penalties. According to the Federal Trade Commission, this issue has been on the rise since 2018, affecting hundreds of thousands of Americans. Even though adults typically commit such crimes, there have been reports of minors using stolen credit cards.

Whether you’re a minor wondering about the consequences of credit card fraud or a parent wanting to explain its severity to your child, you may ask, “Can a minor be charged with credit card theft?”

The short answer is yes, but there are many nuances to credit card fraud you should keep in mind.

Explaining Minor Credit Card Fraud

Credit card fraud is an umbrella term encompassing all unauthorized purchases or cash advances made using a person’s credit card without their consent. Besides stealing someone’s card, the perpetrator might take various actions punishable under federal and state laws:

- Making online purchases using fake or stolen credit card information

- Using fraudulent information to open new credit accounts

- Creating fake credit cards

The above activity is punishable regardless of the perpetrator’s age, so minors aren’t exempt from its consequences. Still, this doesn’t mean all unauthorized use is treated the same way.

Let’s assume a child uses their parent’s credit card to make an in-app purchase. This is technically considered theft, but it’s highly unlikely they’ll be charged with a crime. LendingTree’s survey of over 600 parents showed that 46% had encountered this problem, with the most common unauthorized uses including:

- In-game/in-app purchases

- Food deliveries

- Purchases made through voice-enabled speakers

- Streaming service purchases

While this can be considered stealing, banks have their own rules for unauthorized purchases, and many don’t classify the above actions as such. Only the purchases made after the user’s card has been reported stolen or lost can fall under theft.

With this in mind, a minor will likely be charged with theft if they’ve stolen another person’s card or account information to make unauthorized purchases. The punishment can vary according to the severity of the crime and applicable laws.

How Is Credit Card Theft by a Minor Prosecuted?

Source: Ekaterina Bolovtsova

Depending on the crime’s gravity, minors can be prosecuted for credit card theft at the:

- State level—Local and state governments prosecute most credit card theft cases, with each jurisdiction having specific regulations. The sentence depends on several factors, such as the offender’s criminal history, the dollar value stolen, and the presence of criminal intent

- Federal level—According to 18 U.S.C. §1029, credit card fraud must be prosecuted at the federal level when it affects interstate commerce. Even using a card stolen from a resident of another state falls under this category and typically involves a more severe punishment

It’s hard to predict what might happen to a minor who commits credit card fraud as numerous factors can impact the outcome. Still, looking at penal codes can provide a rough estimate.

Credit Card Fraud Punishment for Minors

The repercussions of credit card theft are determined on a case-by-case basis and classified by penal codes based on the dollar value stolen:

| Penal Code | Amounts | Typical Punishment |

| Infraction | Small amounts | A smaller fine, usually based on the amount of the fraud |

| Misdemeanor | Considerable amount still under the felony threshold (around $1,000 in most states) | Larger fines and/or short jail time |

| Felony | Any amount over the state’s defined felony threshold | Prison time, depending on the exact amount |

As mentioned, the above are only general references—the court will assess how much was stolen and what the money was used for to decide on the sentence. Felony thresholds can vary and be as low as $100 in states like Florida, where the perpetrator can be sentenced to up to five years in prison.

Can a Minor Go to Jail for Using Someone Else’s Credit Card?

A minor might serve time in a juvenile detention center in case of severe theft, though this doesn’t happen often. The justice system is slightly more lenient toward minors than adults who commit comparable crimes.

The main goal of sentencing a minor is rehabilitation, so a more typical punishment would be community service or counseling in case of psychological problems. Adults are considered more rational and capable of distinguishing right from wrong, so their malicious activity carries more weight and is punished more heavily.

This still doesn’t mean a minor will always get a slap on the wrist. If they commit federal credit card fraud, minors might still serve a prison sentence.

What Happens if Someone Else Commits Credit Card Fraud in the Child’s Name?

Credit card fraud goes beyond the theft of a physical card. Many forms involve identity theft, which minors are particularly vulnerable to. Children’s Social Security numbers (SSNs) are typically unused and unmonitored, so fraudsters can use them to create fake identities.

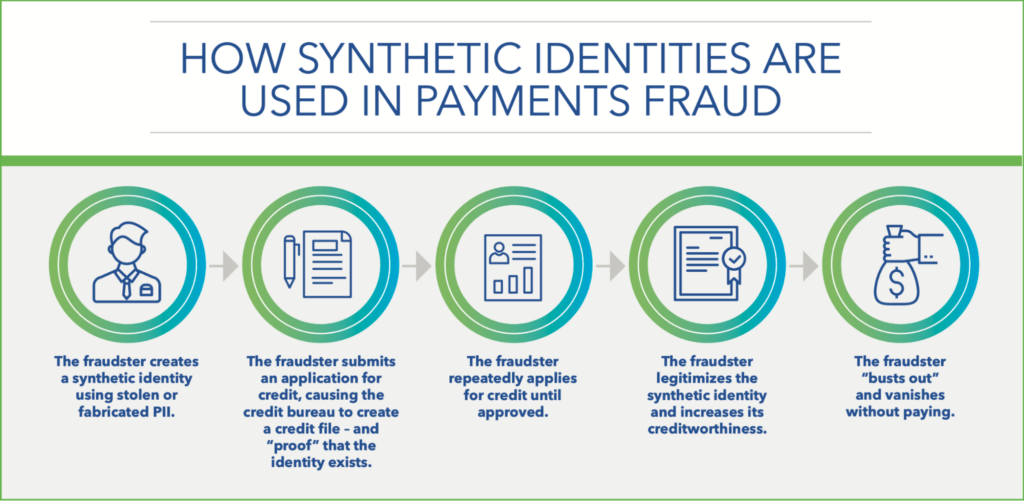

This is known as synthetic identity fraud, where the perpetrator takes out financial products—such as credit cards—using the victim’s SSN combined with fake information like names and addresses.

As the credit account is opened under the child’s SSN, all activity and charges made by the fraudster are tied to it. This can escalate into a major problem because the perpetrator doesn’t repay the lender, as shown in the following diagram from the Federal Reserve’s whitepaper on synthetic identity fraud:

Source: The Federal Reserve: Detecting Synthetic Identity Theft in the U.S. Payment System

If your child falls victim to identity fraud, you must notify all affected lenders and let them know your child isn’t liable for fraudulent activity and stolen funds. This shouldn’t be hard to prove because you can provide a government-issued document connecting your child’s name to their SSN.

It may be difficult or impossible for authorities to identify the fraudster behind the synthetic identity, but it’s important to clear your child’s name and ensure they’re not held accountable for someone else’s crime.

Educate Your Child on Responsible Credit Card Use

No parent wants their child to get in trouble with the law. The good news is that this is preventable with proper education and discipline. Encourage open conversations about money, and emphasize the grave consequences of any criminal activity.

If your child needs access to a credit card, you can add them to yours because minors can’t borrow from banks independently. Before authorizing your child, teach them how to use the card responsibly and stress the importance of healthy spending habits.

A child’s credit card activity doesn’t need to have criminal implications to damage their future. Irresponsible behavior can lead to a low credit score, which can make it hard to rent or buy an apartment, get credit when needed, or even get a job in some cases.

That’s why you shouldn’t give your child access to your card unless you’re certain they won’t misuse it. Even if you are, there’s a better way to help them secure a stable future that doesn’t involve the above risks—FreeKick.

How FreeKick Helps Parents Build Their Children’s Credit and Monitors Credit Profiles

FreeKick—created by Austin Capital Bank—combines a Federal Deposit Insurance Corporation-insured (FDIC-insured) deposit account with additional services to establish and build your child’s credit profile.

An average parent is swamped with various subscriptions, so FreeKick doesn’t want to burden them with yet another one. You can choose between a FREE account with a one-time deposit and another option with no deposit and a low annual fee:

| FDIC-Insured Deposit | Annual Fee |

| $3,000 | $0 (Free) |

| No deposit | $149 |

Getting started is quick and simple—all you have to do is:

- Create an Account—Create an account at FreeKick.bank and choose a deposit that suits your budget

- Set It and Forget It—FreeKick will start building 12 months’ worth of credit history for your child

- Keep Growing—After 12 months, close the account without any fees or continue building credit for your child for another year

FreeKick is a convenient and effective way for minors to build credit. The service will establish their payment history, which will be reported to the three major consumer credit bureaus once they become legal adults. The credit history of young adults (18 and above in most states) will be reported immediately, so your child will get a foundation for a remarkable credit profile that can save them over $200,000 throughout their life.

You can cancel the account at any point without penalties, but note that credit bureaus don’t accept credit reporting for minors. If you close the account before your child becomes a legal adult, no credit can be reported.

Proactive Identity Fraud Detection Through Credit Profile Monitoring

Identity fraud can result in your child being implicated in a fraud they didn’t commit. Parents have limited preventive measures at their disposal, which mainly boil down to checking and freezing their child’s credit report.

Such steps don’t offer enough protection, so FreeKick offers a range of credit monitoring services to reduce the chances of your child falling victim to fraudulent activities.

| Services for Minors | Services for Adult Children and Parents |

| Credit profile monitoring Social Security number (SSN) monitoring Dark web monitoring for children’s personal information Up to $1 million identity theft insurance Full-service white-glove concierge credit restoration Sex offender monitoring—based on sponsor parent’s address | Credit profile monitoring SSN monitoring Dark web monitoring for personal information Up to $1 million identity theft insurance Full-service white-glove concierge credit restoration Lost wallet protection Court records monitoring Change of address monitoring Non-credit (Payday) loan monitoring Free FICO® Score monthly FICO® Score factors Experian credit report monthly |

Reduce the risk of identity fraud and help your child enjoy the numerous advantages of a strong credit profile—sign up for FreeKick.

Featured image source: Anete Lusina

Freekick provides a double dose of financial empowerment and security for your whole family. It helps teens and young adults build strong credit profiles and offers identity motoring for up to two adult parents and six children under 25.