Start Building Your Child’s Credit

Identity theft isn’t new—in fact, it has existed for decades now. Recently, the number of identity theft cases has been increasing rapidly. The dark web is made up of advanced identity criminals who are always learning more sophisticated theft techniques.

Affecting 40 million people in the U.S. alone in 2022, identity fraud and theft have cost the victims billions of dollars in losses. With this in mind, you may be wondering—how many new cases of identity theft daily are there? To help you understand the true scope of this threat, we’ll unmask the daily identity theft numbers. The results may shock you, especially in the case of child identity theft—a particularly common and heinous form of this crime.

Estimates of Daily New Identity Theft Cases

Identity theft has become an increasingly common crime, with thousands of new cases reported daily in the U.S. alone. The Federal Trade Commission (FTC) reported that there were over 1.1 million cases of identity theft in 2022.

This translates to roughly 3,000 cases per day in the U.S. alone. Although the number of cases reduced from 1.4 million in 2021, in 2022, individuals reported a loss of $8.8 billion—an increase of over 30% compared to the $6.1 billion lost by Americans in 2021. These identity theft statistics show the gravity of the crime and the growing impact it has on the victims.

Identity Theft Reports by Type in 2023

As the landscape of identity theft keeps evolving, its threats continue to multiply. According to a 2023 report by FTC, credit card fraud emerged as the leading type of identity theft. Consumers frequently reported unauthorized use of their existing credit card details or misuse of their personal information during new card applications.

However, identity theft can take on numerous other forms you should beware of. Here’s an overview of the common forms of identity theft and the estimated daily reports for each type as of June 2023:

| Rank | Theft Type | Estimated Number of Reports Daily |

| 1 | Credit card fraud | 577 |

| 2 | Loan or lease fraud | 227 |

| 3 | Bank fraud | 213 |

| 4 | Employment or tax-related fraud | 162 |

| 5 | Government documents or benefits fraud | 161 |

| 6 | Phone or utility fraud | 113 |

| 7 | Other identity theft | 370 |

Who Is Most Affected by Identity Theft?

People of different age groups and social profiles face varying degrees of risk when it comes to identity theft. While no one is completely immune, certain groups are more vulnerable than others. These include:

- The elderly

- People with high income or good credit

- Members of the military

- Children

Elderly

Identity thieves often target senior citizens due to their accumulated savings and good credit history. Older individuals may be less informed about the fraud techniques and technology used to obtain information. This makes them more susceptible to scams via phone calls, phishing emails, and fraudulent mail.

People With High Income or Good Credit

Individuals who have a steady income and maintain good credit scores are often attractive targets for identity thieves who aim to open new accounts or secure large loans. Affluent victims may not immediately notice any charges or accounts opened in their name, allowing new cases of identity theft to go undetected every day. Identity protection monitoring services are recommended.

Members of the Military

Military personnel have access to benefits like healthcare, life insurance, and government travel cards. Unfortunately, these benefits can be exploited by identity thieves, as frequent moves and deployments associated with military life make it more challenging to detect fraud promptly because of the lengthy paper trail.

A study conducted by the FTC revealed that military members were more than twice as likely than civilians to report incidents of identity theft. Identity thieves specifically target IDs, mail, personnel records, and government computer systems to obtain their victims’ information.

Children

Child identity theft is becoming increasingly prevalent, especially when it comes to minors. This happens for three main reasons:

- Minors don’t use their identity for credit, so they don’t have a credit profile

- Most minors’ identities are not being monitored, allowing fraud to remain undetected for a long time

- Children born after 2011 were issued randomized Social Security numbers (SSNs). Before that, SSNs were tied to birthdate and geolocation

Identity thieves or even parents or other family members who engage in identity theft can open accounts in a child’s name without it being detected for years. By the time victims are 18 years old and need student loans or want to apply for a credit card, the damage has already been done.

Javelin’s study on child identity fraud reveals that over a million cases of child identity theft occur annually in the United States alone, resulting in $2.6 billion in losses.

Identity Theft Reports by Age

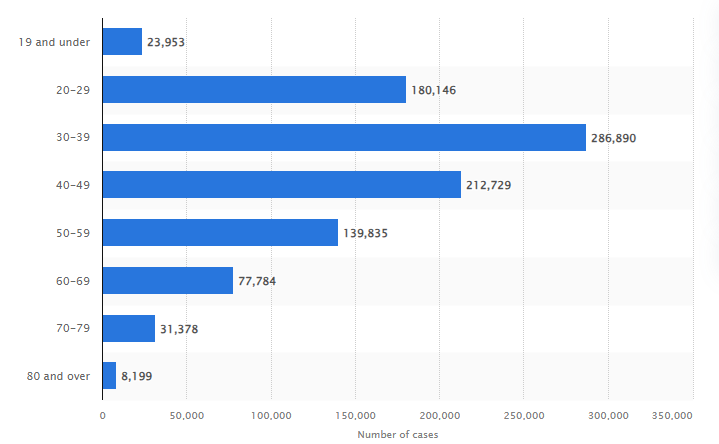

While anyone can fall victim to identity theft every day, it’s crucial for the groups mentioned above to remain vigilant in monitoring their accounts and promptly reporting any suspicious activity they come across.Here’s an overview of identity theft reports by age in 2022 from Statista:

Source: Statista

Although the number of reported cases of identity theft among individuals aged 19 and below seems low compared to other age groups, it doesn’t mean this group is any safer. In fact, we should be deeply concerned about the unique risks faced by this demographic, such as the lack of state ID tracking for this group, which leaves them more vulnerable.

Identity thefts involving minors often go unnoticed for years and only come to light when these individuals start applying for credit cards, loans, or jobs as adults. By that time, the damage caused is difficult to fix and can result in significant emotional and financial hardships during critical moments in their lives.

Proactive Measures To Reduce Child Identity Theft

Setting up identity theft protection for your child can help you ensure they don’t fall victim to new cases of identity theft happening daily. As a precaution, you can try taking the following steps:

- Protect their data

- Monitor both of your accounts and credit reports

- Consider credit monitoring and freezing options

- Stay vigilant

Protect Your Child’s Data

The majority of child identity theft cases occur when personal information, such as SSNs, credit card numbers, and bank account logins, is stolen. It’s important to keep this sensitive data locked up and secure, whether it’s in digital or paper form.

Use unique passwords for accounts and enable two-factor authentication whenever possible. Be cautious when dealing with phishing emails or suspicious links that request information. Additionally, make sure to shred any documents before disposing of them.

Monitor Both Your and Your Child’s Accounts and Credit Reports

Regularly check your bank information, medical bills, and credit card statements for any charges or activity. If your child is old enough, teach them to do it too. Review credit reports from each credit bureau once a year to ensure there have been no accounts opened in your child’s name.

You have the right to receive one credit report from each bureau via AnnualCreditReport.com. Look out for signs like increased balances, late payments, or new accounts that you didn’t open. If you notice anything suspicious, report it to the designated authorities immediately.

Consider Credit Monitoring and Freezing Options

For ongoing monitoring, you may want to consider enrolling in a credit monitoring service. These services provide alerts regarding changes in your child’s credit report so that you can take action if needed.

As a precaution, you have the option to implement a credit freeze on your child’s credit report and restrict access to their credit information. This action serves as a safeguard against account openings. However, it’s important to note that this freeze will also limit your access.

If your child is young and won’t need credit for many years, this is a crucial period to implement a credit freeze. You should make sure to initiate credit freezes with the three major consumer credit bureaus in the U.S., namely:

Stay Vigilant

Unfortunately, identity theft is an ongoing threat. To effectively protect children from identity theft, it’s important to stay vigilant over any warning signs that may indicate breaches. You need to be cautious if you receive unexpected credit card offers or bills in your child’s name. These could include:

- Notifications from the IRS regarding taxes associated with your child’s SSN

- Calls from collection agencies about debts tied to your child

Another red flag is receiving applications for government benefits because someone else is already claiming them using the child’s SSN. You should approach any related correspondence cautiously, especially if it mentions existing accounts or obligations that you didn’t initiate. While the risk can never be reduced to zero, diligence will serve as your best defense against identity theft.

FreeKick Keeps Your Family Safe From Identity Crime

Offered by Austin Capital Bank, FreeKick is an FDIC-insured deposit account that protects your family’s identities and helps build credit for your children.

A secure identity is important for major life milestones, such as securing a college loan and landing a good job. Unfortunately, child identity theft occurs every 30 seconds, which is why it’s crucial to take all precautions against this crime—like using a good identity protection service.

Identity Protection With FreeKick

FreeKick’s identity protection services cover your entire family. Here’s what the service offers for minors and adults:

| Services for Minors | Services for Adult Children and Parents |

| Credit profile monitoring Social Security number (SSN) monitoring Dark web monitoring for children’s personal information Up to $1 million identity theft insurance Full-service white-glove concierge credit restoration Sex offender monitoring—based on sponsor parent’s address | Credit profile monitoring SSN monitoring Dark web monitoring for personal information Up to $1 million identity theft insurance Full-service white-glove concierge credit restoration Lost wallet protection Court records monitoring Change of address monitoring Non-credit (Payday) loan monitoring Free FICO® Score monthly FICO® Score factors Experian credit report monthly |

Credit Building With FreeKick

Secure identities must be complemented by a good credit profile for financial success in life. Enter FreeKick’s credit building service, which is available for children between 13 and 25 years of age.

You’ll have to take three steps to activate the service:

- Create an Account—Create an account at FreeKick.bank and choose a deposit that suits your budget

- Set It and Forget It—Once you activate the account, FreeKick will start building 12 months’ worth of credit history for your child

- Keep Growing—After 12 months, you can close the account without any fees or continue building credit for your family for another year

As a result of establishing credit early, your child will get a credit history head start of up to five years when they turn 18. By enabling them to secure better loan terms and other financial benefits, this will help them save $200,000 during their lifetime.

FreeKick Pricing

FreeKick has two pricing plans:

| FDIC-Insured Deposit | Annual Fee |

| $3,000 | $0 (Free) |

| No deposit | $149 |

Each plan offers:

- Credit building for six children aged 13 to 25

- Identity protection for two parents and six children aged 0 to 25

Secure your family’s identities and their financial future—sign up for FreeKick today.

Freekick provides a double dose of financial empowerment and security for your whole family. It helps teens and young adults build strong credit profiles and offers identity motoring for up to two adult parents and six children under 25.