“My Child Got a Credit Card Offer”—A Step Toward Adulthood or a Red Flag?

Start Building Your

Child’s Credit

As your child grows up, they’ll inevitably be introduced to the banking system at some point. In most cases, this will happen through a checking account and a debit card that will replace their allowance, giving them more independence.

Still, credit products are typically reserved for adults. While minors and young adults might have access to a credit card, it will almost always be their parent’s card until they come of age and meet the conditions for their own.

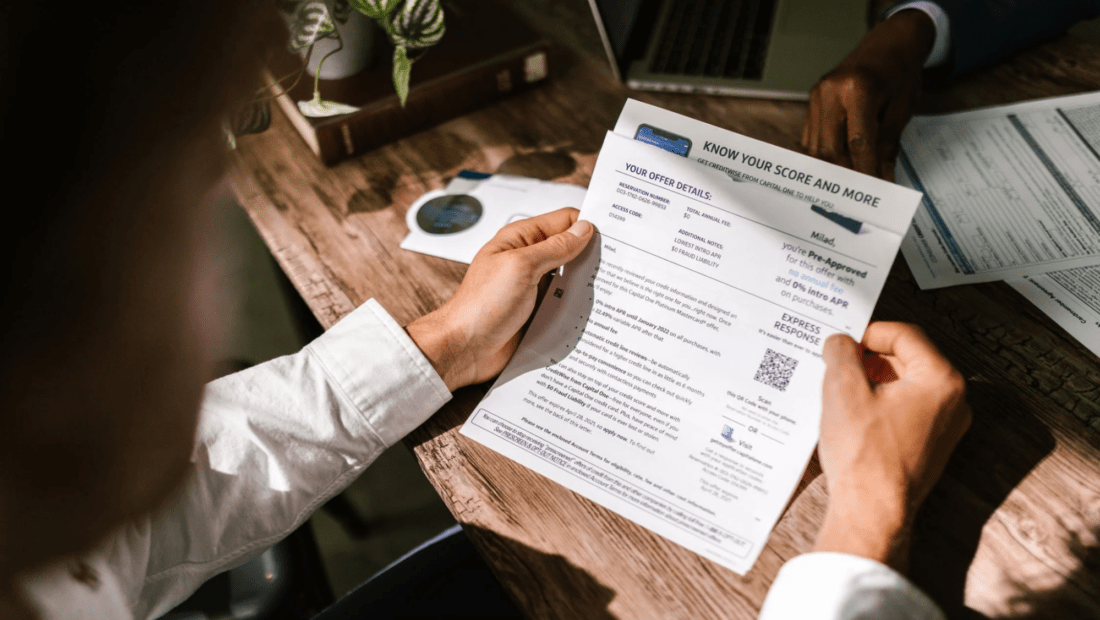

With this in mind, “My child got a credit card offer” is a concerning thing to say. This guide will go through potential reasons why this might’ve happened and explain how to act accordingly.

Is It Common for Kids To Get Credit Card Offers in the Mail?

A child getting credit card offers isn’t normal, especially if they’re a minor. The CARD Act of 2009 imposed numerous limitations regarding credit card issuing and marketing toward children under 21.

According to the Act, credit card companies aren’t allowed to advertise pre-approved offers to anyone under this age. More importantly, children and young adults under 21 can’t obtain a credit card unless one of the two conditions is met:

- The child submits a written confirmation of their ability to make payments independently

- The child has a co-signer aged 21 or over who can assume responsibility for the debt

The above rules apply to legal adults since minors can’t apply for credit cards at all. If your child is under 18, a credit card offer might be a particularly dangerous sign.

Why Is My Child Receiving Credit Card Offers?

If your child doesn’t meet the conditions for having a credit card in their own name, an offer addressed to them could point to identity fraud. This happens to one in 50 U.S. children annually, robbing families of around $1 billion dollars.

Typical identity theft involves impersonation—someone steals another person’s private information (Social Security number, name, address, etc.) and pretends to be them to take out credit and defraud the lender.

This form of identity theft typically targets adults, while children are often victims of a much more elaborate crime—synthetic identity fraud.

How Fraudsters Use Children’s Information To Scam Financial Institutions

Source: Mikhail Nilov

Synthetic identity fraud is complex, but the general mechanism can be boiled down to the following steps:

- The fraudster either steals a child’s Social Security number (SSN) directly or buys it on the Dark Web

- They combine the SSN with a fake name, address, and other details to forge a new identity

- They use the fake identity to take out a loan and then disappear without repaying it

The following diagram from the Federal Reserve’s whitepaper on synthetic identity fraud explains the process in more detail:

Source: The Federal Reserve: Detecting Synthetic Identity Fraud in the U.S. Payment System

Synthetic identities are difficult to detect because the Social Security Administration (SSA) started randomizing SSNs in 2011, so they no longer contain the geographically-defined area code or the holder’s birth date. Such information would make it easier to trace the number back to its true holder.

Identity fraud can have serious consequences if not resolved timely and effectively. When a fraudster takes out credit using your child’s identity, the victim gets a credit report connected to their SSN. As the perpetrator doesn’t make repayments, they could severely damage your child’s credit profile.

A low credit score makes it extremely difficult to take out loans, so such issues would close many doors for your child. To fix the damage, you’d have to dispute all fraudulent activity, which can be a complex and time-consuming process.

How To Know if Your Child’s Identity Has Been Stolen (And What To Do About It)

A credit card offer isn’t the only sign of identity fraud—there’s a lot a fraudster can do with a fake identity besides applying for credit. They can apply for government benefits in your child’s name, getting them rejected when making a legitimate request later in life.

The scammer can also apply for a job and use the child’s information on tax forms, in which case the IRS might send you a letter saying your child hasn’t paid income tax.

A reliable way to figure out if your child’s identity has been compromised is to check if they have a credit report. You can do so with any of the three major consumer credit bureaus:

- Experian

- Equifax

- TransUnion

If your child has a credit report but no legitimate credit history, there’s a high chance someone has used their SSN to open the file and take out a credit card or loan.

In this case, you’d have two options for minimizing the damage:

| Action | How It Works |

| Credit freeze | When you freeze your child’s report, it becomes inaccessible to new lenders, preventing the fraudster from opening new credit accounts as the bank can’t do a credit check |

| Fraud alert | Placing a fraud alert with any of the bureaus notifies all three, urging lenders to do a more thorough background check to confirm the credit applicant’s identity |

Is There a Legitimate Way for a Child To Have a Credit Report?

Even if your child is a minor, having a credit report doesn’t always mean their identity has been compromised. The only legal way this is possible is if you’ve added them as an authorized user of your credit card.

Many parents do this to teach their children about credit cards and help them develop healthy spending habits. Some also believe that adding a child to their card will help them build credit early on, but this is only true to an extent.

While your child does get a credit report earlier than they would independently, they only build credit while they’re named as an authorized user. They inherit your credit score and piggyback on it until you remove them from the card. When you do, all credit activity associated with the card gets deleted from their report, so they’re back to square one.

Luckily, there’s a more effective way to help your child build credit and be proactive about identity fraud instead of waiting until the damage is done. FreeKick can check both boxes to give you peace of mind and help you secure a financially sound future for your child.

Build Your Child’s Credit and Protect Their Identity With FreeKick

There are two aspects of a good credit profile—a secure identity and a good credit score. Offered by Austin Capital Bank, FreeKick is an FDIC-insured deposit account that helps you cover both these aspects for your child.

Steps for Using FreeKick’s Credit Building Service

Your child is eligible for FreeKick’s credit building service if they’re between the ages of 13 and 25. This service is a good way to help them establish a credit history early on in life in only three simple steps:

- Create an Account—Create an account at FreeKick.bank and choose a deposit that suits your budget

- Set It and Forget It—FreeKick will start building 12 months’ worth of credit history for your child

- Keep Growing—After 12 months, close the account without any fees or continue building credit for your child for another year

With these steps, your child can have up to five years of credit history when they turn 18. This will help them save $200,000 during their lifetime by helping them secure better loan terms and other financial benefits.

How FreeKick Protects Your Child’s Identity

Child identity theft happens every 30 seconds, and if your child falls victim to it, all your credit building efforts can go to waste. In the worst case, your child might get charged with crimes like credit card theft, so it’s a good idea to proactively invest in protecting their identity. FreeKick’s ID protection services include:

| Services for Minors | Services for Adult Children and Parents |

| Credit profile monitoring Social Security number (SSN) monitoring Dark web monitoring for children’s personal information Up to $1 million identity theft insurance Full-service white-glove concierge credit restoration Sex offender monitoring—based on sponsor parent’s address | Credit profile monitoring SSN monitoring Dark web monitoring for personal information Up to $1 million identity theft insurance Full-service white-glove concierge credit restoration Lost wallet protection Court records monitoring Change of address monitoring Non-credit (Payday) loan monitoring Free FICO® Score monthly FICO® Score factors Experian credit report monthly |

FreeKick Pricing

FreeKick offers two pricing plans:

| FDIC-Insured Deposit | Annual Fee |

| $3,000 | $0 (Free) |

| No deposit | $149 |

With both plans, you get:

- Credit building for six children aged 13 to 25

- Identity protection for two parents and six children aged 0 to 25

Make sure you cover all bases when setting up your child for financial success—sign up for FreeKick today.

Featured image source: RODNAE Productions